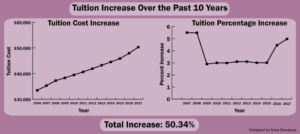

In 2006, Lehigh’s tuition was $33,470.

Fast forward 10 years, and that cost has risen by 50 percent.

On March 23, Pat Johnson, the vice president of finance and administration, sent an email to students and parents informing them of a 5 percent rise in tuition for the next academic year, from $47,920 to $50,320.

Johnson said the $2,400 increase will go toward funding several activities, including hiring new faculty, improving academic buildings and classrooms and expanding new programs like the Data X initiative. She said some of that money will also go into the financial aid budget.

Johnson said the cost of operation increased as a result of new labor laws and regulations related to compliance. The Affordable Care Act, enacted in 2010, defines a full-time employee as anyone who works more than 30 hours a week. Johnson said this increased the number of staff who receive health benefits from the university. She said a portion of the tuition money will go to providing these benefits to faculty and staff.

Johnson said the money will not go toward the Path to Prominence expansion plan because it’s too early in the planning process to start allocating funds to the initiative.

Five percent is the university’s largest tuition increase since 2008. Last year, tuition increased by 4.5 percent, and before that, it increased at a rate of approximately 3 percent for seven years.

Johnson said tuition increases were kept moderately low from 2013 to 2015 because trustees wanted to experiment to see whether the price attracted more applicants from middle-class families. Johnson said their plan didn’t work.

“When we were doing 3 percent increases, other schools were doing four and five,” Johnson said. “Now we’re kind of catching up a little bit.”

For example, Johnson heard Lafayette’s tuition is increasing by 4 percent next year, but she said Lafayette had been increasing by 4 percent during the years Lehigh had only been increasing by 3 percent.

Johnson said parents have contacted her to express their disapproval of the tuition hike.

Sophie Clowes, the mother of a first-year student, said parents have also taken to Facebook to talk about it in the “Lehigh University Parents and Families” group.

She said although some parents have justified the increase as a good investment, the majority are mad about it. Clowes said the parents who wrote in the Facebook group wanted to see improvements in residential buildings and dining halls before they gave more money to the university.

She also said parents expressed concerns about not being able to afford tuition, especially if it keeps increasing at this pace.

“A lot of families can just about afford to pay this, but it’s at a big sacrifice to them,” Clowes said.

In retrospect, she said the increase probably would have affected her decision to send her son to Lehigh. Clowes, a California resident, said she wants Lehigh to gain greater national recognition if she is going to pay over $50,000 in tuition each year.

“We live on the West Coast, and no one has heard of Lehigh,” Clowes said. “If our son comes back to work here, I’m not sure that Lehigh will get him through the door.”

Clowes said Lehigh should be pulling money from its endowment, which is approximately $1.2 billion, instead of placing more financial burden on families. However, Johnson said the university only has access to the spending rate each year, which she said is an average of 5 percent.

“Even though it looks like we have a lot, we don’t have a lot at our disposal,” Johnson said.

With the financial market projected to not do as well in coming years, Lehigh is considering reducing its spending policy. Johnson knows parents won’t be happy about the change, but she said the endowment money is supposed to last forever and needs to be protected.

Donald Outing, the vice president for equity and community, said his priority is making sure there’s enough money in the financial aid budget to offset the rise in tuition.

With the rising cost of college nationwide, Outing said Lehigh needs to be wary of following that national trend.

“Hopefully Lehigh or other institutions don’t price themselves out of these opportunities and become so financially cumbersome that we can’t even overcome it with financial aid and scholarships,” Outing said.

Johnson recognizes this possibility, and she said it is always a factor in the decision to raise tuition.

Although Johnson acknowledged Lehigh’s tuition is high, she encourages families to see the price tag as an investment.

“I think in Lehigh’s case especially it is very clear that a college education is well worth it as far as job placement and salary over the years,” Johnson said. “Even though this is a lot of money, you get your return. It’s a good investment.”

In terms of deciding whether the investment was worth it, Johnson thinks there are two ways students can measure that.

The first is whether your job after college is sufficient enough to pay for the cost of education. The second, harder to put a price tag on, is the amount of happiness your four years at Lehigh brought you.

Comment policy

Comments posted to The Brown and White website are reviewed by a moderator before being approved. Incendiary speech or harassing language, including comments targeted at individuals, may be deemed unacceptable and not published. Spam and other soliciting will also be declined.

The Brown and White also reserves the right to not publish entirely anonymous comments.

7 Comments

Another 10 years and the cost of tuition and other related cost (housing, food, books etc) will kill private institutions like Le High. The cost now for 4 years is over $350K. Ten years the cost will be over $500K.

$350K or $250K? I think it’s $250K

I guess it’s a vicious cycle…. the higher the cost of tuition at Lehigh the more they need to offer attractive financial aid to entice a variety of students. Maybe it’s time to reevaluate being “deeply committed to need-blind admissions” like other universities. Time they open their eyes to see our pockets aren’t bottomless and such high increases, especially for us paying full ticket price may out price them right out of the market. Lehigh’s boast of being need blind is falling on our deaf ears with such high increases over the past two years when we have to work a bit harder and sacrifice a little more to keep our children at Lehigh. For us who don’t qualify for aid especially with multiple kids in college, we are tired of hearing “it’s well worth it” and when I do the math it takes much longer to see any return. Let’s see what the board decides for 2018/2019 tuition because whatever their thinking, it’s time to reevaluate and give us a break.

Not only has the tuition reached ridiculous levels, the ancillary costs of room and board are similarly outlandish.

Even more important, however, is that Lehigh has become a farce with regards to academic rigor and the amount of coursework required to earn a degree.

Grade inflation is a problem throughout the academic world. Professors routinely dole out undeserved high marks so that they won’t have to deal with the whining of their perpetually aggrieved “customers”.

Lehigh refuses to publish statistics of even the most basic metrics such as the GPAs for All Undergraduates, All Undergraduate Males, and All Undergraduate Females.

The phony argument has been made that such data are not published due to privacy concerns.

This is ludicrous, as certainly nobody’s privacy is violated when his/her data is averaged in with several thousand other people.

Many courses that used to be considered worth 3 credit hours are now 4 credit hours. However there has been no increase in content, the number of hours in the classroom, or the complexity of homework assignments.

The number of credit hours needed to earn a degree has not been increased.

Thus while the costs are going up, the students are getting less education as well. A double negative whammy!!!!

Anecdotal evidence tells me the undergraduates are now partying almost every night of the week.

Clearly, their studies load is too light such that they have that much spare time.

Not sure these private schools are worth the $150K difference over State schools. That’s after graduating one from a State school and having one who will graduate from Lehigh in 1 year. Jobs and pay are virtually the same. The experience at Lehigh is much better. Is that worth $150K?

Would like to see some thought or effort to reduce costs, it seems administrators come from perspective that it’s ok to increase ad infinitum. Just imagine if Lehigh were to say they were reducing tuition 10pct because they reduced costs, that would get National headlines!

Pingback: Syracuse University’s $3,300 tuition premium is unusually pricey, experts say - The Daily Orange - The Independent Student Newspaper of Syracuse, New York