Chuck Fisher came to Lehigh with dreams of changing the world for the better.

Chuck Fisher came to Lehigh with dreams of changing the world for the better.

After receiving his undergraduate degree in biotechnology from Marywood University, he is now pursuing his doctorate in molecular and cellular biology at Lehigh.

He spends hours in the lab as a research assistant, sometimes even on the weekends. It’s his full-time job until he obtains his doctorate.

Fisher receives a stipend of $25,000 a year as a research and teaching assistant. Lehigh provides him with a tuition waiver to cover his tuition, a bill he never sees. Under current law, Fisher and the other doctoral candidates do not pay federal income tax on the tuition waivers.

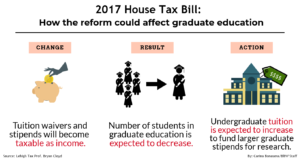

Now, with the provisions in the United States House of Representatives’ tax reform bill, Fisher will have to pay tax on his tuition waiver. The proposed tax bill makes those waivers part of taxable income.

With the new tax reform bill, Fisher said sustaining his cost of living will not be feasible. He said it may impact his ability to finish the program because of the need to pay for his taxable stipends.

Fisher said the stipend covers rent, health care, groceries and general costs of living. He said with the change happening so fast, it’s difficult to accommodate. Fisher and his wife, a Catholic school teacher making only $19,000 a year, are already trying to manage their costs.

Fisher is one example of 1,942 Lehigh graduate students and graduate students nationwide who face increased taxation if the final Senate tax bill makes tuition waivers taxable. More importantly, the bill will affect many doctoral candidates, specifically in STEM fields.

While the tax bill passed in the House in a 51-49 vote, the same bill did not pass in the Senate. In fact, the provision on making waivers taxable was removed. The next step is for the Tax Reform Conference Committee to discuss the final legislation changes before sending it to President Donald Trump.

Pat Toomey, the U.S. senator for Pennsylvania, was asked Wednesday night to be a part of the committee.

“The Senate bill does not change any of the tax treatments on incentives paid to graduate students, as the House does,” read a statement released by Toomey’s office. “Should the tax treatment of these incentives come up for debate during the conference committee, it is important to remember that tax reform extends beyond singular changes and deductions. So while both the House and Senate plans to adjust tax treatment for certain entities and eliminate certain deductions, they both also lower rates, double the standard deduction and increase the child tax credit, resulting in a net tax cut for millions of working-class and middle-income Pennsylvanians.”

Fisher said for many of his peers, it will be extremely difficult to continue in their graduate programs if these changes are made. Students will have to reconsider if it’s worth pursuing advanced degrees.

Tax professor Bryan Cloyd said the House tax bill will not only affect current graduate students, but it will be detrimental to higher education.

“Universities cannot achieve their teaching and research missions without the services of graduate students working as teaching and research assistants,” Cloyd said. “If section 117(d) is repealed, universities will have to increase graduate student stipends in order to compete for the best and brightest graduate students. Ultimately, undergraduate tuition would have to increase to cover these additional costs.”

If taxable tuition waivers become the law, Cloyd said doctorate students could see as much as a $3,000 increase in income taxes at a 12 percent tax rate, plus another $1,900 for social security and Medicare taxes. Essentially, doctoral candidates will have to pay an extra $4,900 in taxes.

“Lehigh would have to increase graduate students’ taxable stipends, which would itself be taxable,” Cloyd said.

If the Senate bill passes, this new tax could begin in April 2018.

Fisher said Congress should be more understanding, considering nearly everyone voting on this bill has a college degree and many have advanced degrees.

He said the House bill will not only affect Lehigh students, but also the professors.

“My adviser and every other adviser here is depending on the graduate students,” Fisher said. “Their careers do not advance without our help, especially in the sciences — teaching assistants are running labs and helping relieve some of the course load.”

Nick Ungson, ‘18G, the Graduate Student Senate President, discussed the provisions in the House tax reform bill affecting graduate students in their student senate meetings. Ungson is pursuing his Ph.D. in Social Psychology. (Courtesy of Nick Ungson)

Graduate Student Senate president Nick Ungson said graduate students were made aware of the bill in their meetings. If the bill is passed, they plan to hold discussions starting next semester.

Ungson, who is pursuing his doctorate in social psychology, hopes to become a university professor. He is nervous his ability to recruit students will be harmed if taxable tuition waivers are included in the Senate bill.

Dominic Packer, the associate dean for research and graduate programs, said scholarships would remain separate from taxable income. Parker said someone who is a presidential scholar or a residential assistant will not have to pay this tax, and it only affects students who are receiving stipends.

“Depending on what happens, we will continue to do our utmost to support our graduate students and the scholarly mission of the university,” Parker said. “Graduate students are fundamental to what we do every day here. They are one of our top priorities. No matter what the ultimate bill looks like, we will figure out a way to continue to support our students…Until we know the details, we are not sure what kind of response we will need to make.”

In the meantime, Parker and Ungson recommend students contact Lehigh County’s 15th Congressional district U.S. Rep. Charlie Dent or any other congressman or senators who will vote on the final bill.

Students like Kristin Anderson have gotten involved in bringing awareness to the bill.

Anderson is currently in her fifth year of her doctoral studies in neuroscience. She decided to pursue higher education after working in a research lab.

Anderson, Ungson and Fisher are among many Lehigh students who have made countless calls to Dent and other senators, expressing their concerns about the provision that makes tuition waivers taxable.

Fisher and Anderson have signed a letter that outlines the issues with the overall bill.

On Dec. 5, Anderson took her concerns and visited Toomey’s Allentown office, where a bipartisan group protested outside for an hour.

“If we keep the pressure on, hopefully, this provision won’t be in the final bill,” Anderson said. “Hopefully we won’t have to face this reality that affects academia, research and higher education.”

Comment policy

Comments posted to The Brown and White website are reviewed by a moderator before being approved. Incendiary speech or harassing language, including comments targeted at individuals, may be deemed unacceptable and not published. Spam and other soliciting will also be declined.

The Brown and White also reserves the right to not publish entirely anonymous comments.

2 Comments

Do you think this might mean Professors will have to teach more than 3 classes per week instead of have assistants cover for them?

It means that your parents will have to pay more for your tuition and cut back on their country club dues