The Green Action club will meet with President John Simon and Lehigh’s administration later this month to discuss establishing more ethical policies regarding the university’s investments.

“Right now, there is little to no policy on ethical investments,” said Justin Landowne, ’18, the Green Action club’s programming coordinator. “There is no language at all about ethics.”

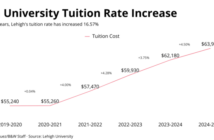

According to Lehigh’s current public endowment allocations, roughly 4 percent, or $48 million, of its $1.2 billion endowment is invested in natural resources, which include fossil fuels and natural gas.

Green Action met with the administration last semester to discuss divesting from all fossil fuels and natural gas. Andrew Goldman, ‘19, the activism chairperson of Green Action, said the divestment plan, once in action, would put an immediate freeze on fossil fuel investments followed by a gradual five-year removal.

“Divestment from fossil fuels is a campaign that exists at thousands of universities across the world,” Goldman said. “It’s already been successful at over 600 (schools). Our goal here is to have Lehigh join those ranks as a climate leader.”

Over $3.4 trillion in assets have been divested worldwide as of December 2015.

Albert Wurth, a professor of political science and the adviser of Green Action, said there seems to be a wall between the ethical and philosophical mission of the university and its financial decisions.

“We know we don’t want there to be lucrative possibilities in the illegal drug trade,” Wurth said. “But we don’t consider that to be within the realm of viable investment.”

The previous financial investment officer told Wurth Lehigh would invest in anything but illegal trades.

“There should be no climate change deniers in the university’s administration,” Wurth said. “To behave as if business as usual will not lead to contributing to the crisis is a pretty difficult claim.”

The endowment is not directly invested in individual companies, wrote Lori Friedman, Lehigh’s director of media relations, in an email.

Investments are made through private investment managers. Investment managers are chosen by the investment office and the investment subcommittee of the board of trustees, she wrote.

In years past, Green Action has asked the administration about its investments and was told 5 to 10 percent of the endowment is invested in fossil fuels.

A study conducted by MSCI and the Aperio Group in 2013 examined the effects of removing the 13 most harmful coal companies from the Russell 3000 index.

According to the study, removing investments in coal companies increased financial risk by 0.0006 percent, a statistically irrelevant percentage. By removing the entire oil, gas and consumable fuel sector, the risk increased by 0.01 percent.

Wurth said he thinks Lehigh has not yet divested because of conventional thinking and a herd mentality with other schools. He said standard practices on college campuses create an institutional inertia, putting the pressure and risk of divesting on decision-makers within a university’s administration.

“Large institutions do what they did yesterday — they’re like giant ocean liners that are really hard to steer,” Wurth said. “The notion that there isn’t an alternative investment that probably has the same predicted yield and risk, but wouldn’t be contributing to the challenges to the planet, is pretty small.”

Goldman said with coal and oil industries on the decline, the one resource that has been growing is natural gas, primarily through fracking. Fracking has had many negative effects on communities in the past, including contamination of water supplies.

Some consider natural gas a bridge fuel that will eventually be transferred into clean energy.

“That’s a load of horse crap,” Goldman said. “Investing in natural gas that we know we can’t be using is ridiculous when we can just invest that money in proven solar, wind and renewable resource infrastructure.”

Landowne said divesting shows communities, schools and companies that investments in natural resources aren’t necessary to succeed. He said if a company is truly immoral, Lehigh shouldn’t be investing in it.

Goldman said there would not be a significant dent in stock prices if universities like Lehigh were to divest. He said divesting would send a social message that institutions dedicated to higher education are not supportive of industries that harm the future.

“The university would probably feel shaky foregoing a great deal of income that could be spent on students,” Wurth said. “But the likelihood of that is really small. You don’t just stop investing in fossil fuels and throw that money down the drain. You start investing in something else.”

To promote awareness, Green Action handed out square orange pins to be displayed on backpacks.

“What we want to do with (the orange squares) is make the movement visible,” Goldman said. “You can have a lot of support, but people don’t realize that, ‘Hey, wow, look at all these people who support the divestment movement.’”

Comment policy

Comments posted to The Brown and White website are reviewed by a moderator before being approved. Incendiary speech or harassing language, including comments targeted at individuals, may be deemed unacceptable and not published. Spam and other soliciting will also be declined.

The Brown and White also reserves the right to not publish entirely anonymous comments.

4 Comments

Their is nothing immoral about investing in fossil fuel companies other than the people advocating such hypocracy as they are likely the same people voting for Clinton who takes money from the Saudis while espousing the same myths about man made global warming -oops climate change!!

Green Action needs to face the real world that needs fossil fuels to grow economies to lift people out of poverty in the US & around the world. Stop overplaying your hand by using alarmist tactics to bully Lehigh into following other weak Universities down the politically correct path for no reason.

Stand tall Lehigh.

If we don’t take serious action to address the VERY REAL effects of climate change, it will put more people in poverty than it lifted out; ie. all 7 billion of us. Changes in weather patterns will only lead to more and deeper droughts in various regions of the world, leading to massive food shortages and widespread starvation [1]. Rising seas will lead to millions of refugees that have been pushed from their homes as they get swallowed by the ocean, which is already happening in America [2], and across the world, and it will only get worse [3].

Investing in these companies that are destroying our future, buying our government [4], and polluting our air and water [5], is absolutely immoral. Profiting at the expense of others’ livelihood and future is certainly immoral.

GreenAction does not need to “face the real world,” YOU DO. You need to realize that climate change IS REAL and affects all of us, and we will not rest until our future is safe.

[1] http://www.giss.nasa.gov/research/news/20161012/

[2] http://www.nytimes.com/2016/05/03/us/resettling-the-first-american-climate-refugees.html?_r=0

[3] http://nationalgeographic.org/encyclopedia/climate-refugee/

[4] http://priceofoil.org/fossil-fuel-industry-influence-in-the-u-s/

The global governmental and scientific consensus confirms the urgency of addressing climate change. Here are a couple of relevant websites:

http://climate.nasa.gov/scientific-consensus/

http://www.ucsusa.org/press/2016/new-study-ranks-eight-major-fossil-fuel-companies-their-climate-change-actions#.WBC6r3opCBY

Ethical investing is all relative. These individuals enjoy the benefits of attending a 60k school a year, driving cars, and using a computer powered and manufactured using majority fossil fuel power. Based on models, these individuals are all for changing energy sources. Models, filled with statistics and assumptions, missed badly predicting many states in the election. Modeling climate includes significantly more assumptions and inherent uncertainty, with much larger error. Still, these individuals are happy to transfer jobs from West Virginia, Kentucky, Pennsylvania, etc to silicon valley, NYC, etc where money will be dumped into R&D projects at universities and green tech companies to produce uncertain returns. Energy prices increasing 5% may not affect them personally, but will massively increase the cost of manufacturing in Southern and midwestern states. Coal profits flowed out of Appalachia into the North East and helped to fund the opulence of NYC over the past 150 years, and now that their needs have been satisfied, these individuals want to lecture others about how they’re destroying the planet. Acts like this divestiture make people feel good about themselves, but they have real world consequences. No one wants to live in a polluted and dirty world, but emotional campaigns based on uncertain models (with little feedback since a prediction 40 years in the future can’t be tested for accuracy of the model and assumptions) are dangerous.