Lehigh Valley Cold Storage Co. is currently under renovation at its current location on 321 Adams St. The renovations have been funded through the Historic Preservation Tax Credit system that was approved by the Pennsylvania Department of Community and Economic Development. (Musa Jamshed/B&W Staff)

Renovations are underway to convert the Lehigh Valley Cold Storage Co. into an apartment building at 321 Adams St. in South Bethlehem, thanks in part to new tax credits.

This conversion of the Lehigh Valley Cold Storage Co. was aided by grants from the Redevelopment Capital Assistance Program. Pennsylvania state Sen. Lisa Boscola (D-Lehigh/Northampton) secured these funds through the Historic Preservation Tax Credit system that was approved by the Pennsylvania Department of Community and Economic Development and in conjunction with the Pennsylvania Historical and Museum Commission.

“I advocated awarding tax credits to this project in communications with the Department of Community and Economic Development’s Secretary Dennis Davin prior to its approval,” Boscola said.

Bethlehem-Adams LP was awarded $200,000 in tax credits, which will go toward the conversion of the Cold Storage Co. into 30 one- and two-bedroom apartments known as the Brinker Lofts.

The project is a public-private partnership. The land is owned by Lehigh University, and the property is being developed by Jefferson-Werner, according to Boscola’s press release. The Department of Community and Economic Development granted these funds once the project was deemed a “qualified historic structure” with a “qualified renovation plan” for said structure.

Boscola’s press release said the structure was originally built in 1893 by Adam Brinker, who was the president of Lehigh Valley Cold Storage. In addition to being a cold storage place, the company made ice.

Boscola said the tax credits will assist in the completion of the project, which has an overall cost of over $8 million. The Brinker Lofts apartments will ultimately aid in the redevelopment of the South Side.

“Indirectly, it will send an important message that buildings along this corridor can, in fact, be redeveloped, and that will have an extremely positive impact on our local and state economy,” Boscola said.

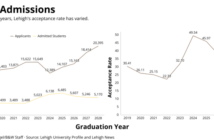

Given the property’s close proximity to Lehigh’s campus, the Brinker Lofts are likely to provide another off-campus location for student housing, though the apartment complex is not exclusive to Lehigh students. Lehigh plans to admit 1,500 more students over the next 10 years under its Path to Prominence initiative, and housing has become an issue in recent months.

David Peterson, ’21, said this new development could be a game changer.

“This new renovation has inspired me to consider living in the Bethlehem area after I graduate,” Peterson said.

Although only $3 million has been allotted directly to redevelopment funding throughout the Commonwealth of Pennsylvania, the tax credits allocated to 21 projects will leverage an estimated $257 million in construction projects, Boscola said.

Boscola credits the strong economy which “allowed the developers to put together a financing package that made this project feasible when including the awarding of the tax credits.”

This latest project has generated excitement among the student body. Kerry McHugh, ’22, said that the redevelopment of the Company is of interest.

“I see the South Side as an up-and-coming area with a lot of possibility for change and innovation,” McHugh said.

Comment policy

Comments posted to The Brown and White website are reviewed by a moderator before being approved. Incendiary speech or harassing language, including comments targeted at individuals, may be deemed unacceptable and not published. Spam and other soliciting will also be declined.

The Brown and White also reserves the right to not publish entirely anonymous comments.

3 Comments

So um. Any low-income-tenancy requirement for that development of luxury flats in a historic building, or is the state money all going to help fund their development for the expected use of young people, many from out of state, going to a private sixty-seven thousand dollarino university? Because it occurs to me that last spring there was a story about a youth center in that neighborhood that had to close for want of funds. $200K isn’t all the money in the world, but it’s not trivial, either.

Great to see the developer working with the state of PA and the National Park Service to receive various tax credits like Federal Historic Tax Credits to achieve the goal of Dept of Interior program – saving the historic fabric of american building architecture – in a blue collar area like south Bethlehem…even it does not solve all the ills of society that Ms. Charles thinks need to be burdened onto such a development.

Bravo developers. Rehab’d buildings are also very green due to saved material and energy and most costs are wages for rehab (not materials) so the impact on local communities skilled labor and working lower class is significant. Read studies by the National Trust for Historic Preservation or Cornell University and you will learn the significant impact that rehabilitated, commercially viable historic property has on the local community and city. And yes some of these developments do produce affordable and workforce housing.

Some do, usually because the municipality requires it before they’ll grant approval. The question is whether this one does. Any info, Sarah?