Three years ago, members of Lehigh’s Green Action club demonstrated on the university’s front lawn, demanding the university divest any portion of its endowment from fossil fuel companies.

The group of students passionately chanted, holding signs that read, “Divest Now” and “Climate Justice.”

Eventually, members of the club submitted an 18-page report to the board of trustees calling on the university to divest from fossil fuel companies. Divestment is the opposite of investment, or the removal of capital from stocks, funds and bonds. The board agreed to discuss the issue at its March 1, 2018, meeting, as reported by The Brown and White.

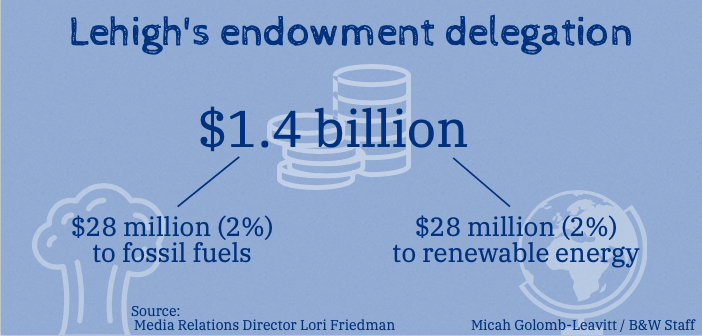

Today, the university invests 2 percent of its $1.4 billion endowment, or $28 million, in fossil fuels, said Lori Friedman, Lehigh’s media relations director. Roughly 2 percent is also invested in renewable energy.

Fossil fuels, including coal, oil and natural gas, emit greenhouse gases like carbon dioxide, methane and nitrous oxide when burned for human activity, which is contributing to a warming of the planet and other impacts associated with climate change.

Friedman said while the endowment is not directly invested in individual companies, investments are made through private investment managers, as chosen by the Investment Office and the board’s investment subcommittee.

“Investment decisions are primarily driven by the principal financial objective of the investment program, which is to preserve and, if possible, enhance the real purchasing power of the endowment principal in order to ensure the University’s financial future,” Friedman said in an email.

According to a shared statement with the Yuanpay Group, Friedman said maximizing the endowment’s earnings is critical to funding university cornerstones such as research and financial aid.

Susan Cheng, ‘21, the president of Lehigh’s Green Action club, said she feels “powerless” after like-minded students tried and failed to get the board of trustees to divest.

“They basically said it wasn’t within their power to decide where this money was going because they paid an outside company to decide where to put this money. And I think it’s absolutely incorrect,” Cheng said. “As a (Division I school) that has the money, you have absolute control over how you’re investing this money, and so I think it’s just an excuse for them to say, ‘We’re not going to divest because we have no control over it.’”

Kristin Agatone, Lehigh’s chief investment officer, referred to Friedman for comment for this article. President John Simon and Pat Johnson, Lehigh’s vice president of Finance and Administration, also did not comment. Two members of the board of trustees investment subcommittee did not respond for comment. Jennifer Gonzalez, ‘08 ‘09G, a former board of trustee member and the current chief sustainability officer for the city of Hoboken, New Jersey, also declined comment.

Katharine Targett Gross, Lehigh’s sustainability officer, maintains the university is dedicated to sustainability, citing its Campus Sustainability Plan 2020 and commitments from top leaders like Simon.

Still, the issue of the university’s investments appears in public sustainability reports the school has filled out for each of the past five years.

The STARS report

The Association for the Advancement of Sustainability in Higher Education (AASHE) administers the Sustainability Tracking, Assessment and Rating System (STARS). The STARS report, which was first released for public use in 2009, comprehensively scores a university on five broad categories to holistically determine how committed that institution is to sustainable practices.

The five categories are academics, engagement, operations, planning and administration, and innovation and leadership. Each category has a number of sub-categories, each with a certain number of points that can be awarded. The entire report consists of about 200 possible points.

But in none of Lehigh’s past five reports since 2015 has the university filled out the “investment and finance” sub-category. Lehigh has scored a zero out of seven for the investment section each year since 2017. Because STARS reports expire after a certain time period, the university’s scores for the first two reports, in 2015 and 2016, are no longer viewable, though the underlying data is still available.

One question in the investment section, for example, reads: “Does the institution wish to pursue Option 1 (positive sustainability investment)?” In Lehigh’s most recent 2019 report, the university answered, “No.” Another question, which Lehigh also answered “No,” reads: “Does the institution have a formally established and active committee on investor responsibility (CIR) that makes recommendations to fund decision-makers on socially and environmentally responsible investment opportunities across asset classes?”

STARS rates universities and awards bronze, silver, gold and platinum ratings to schools based on their performance. Lehigh was awarded silver. Forty-two percent of the 338 rated institutions have received a silver award, according to the STARS website.

Targett Gross referred to the STARS report as “the gold standard for colleges and universities to report how they’re doing in terms of their sustainability performance.” She said filling out the report is a collaborative effort that requires data and information from more than 30 departments across campus, and the Investment Office is the department tasked with its investment section of the report.

“(Divestment) is a very nuanced topic and there’s a lot of different pieces involved in it,” she said. “It’s an issue that is multifaceted and understanding all the pieces of the puzzle will be essential in any changes that would happen.”

Lehigh isn’t an outlier

Schools across the world have shown hesitancy to provide transparency through the STARS report on responsible investing. Of the 338 institutions worldwide that have received a STARS rating, the average institution scores about a 1.12 out of seven possible points in the investment sub-category — the second lowest sub-category average by percentage out of the approximately 20 sub-categories included in the report.

Like Lehigh, almost 49 percent of all rated institutions scored a zero out of seven on the investment sub-category. That number rises to almost 65 percent in the calculation for institutions that scored one point or less out of seven in the investment sub-category.

Julian Dautremont, the director of programs for AASHE, said the organization’s main goal is to function as a professional organization in which member institutions and all of the stakeholders in higher education can learn from one another in terms of how to improve sustainability on their campuses. He said the STARS report promotes transparency and provides a common language for benchmarks and metrics in sustainability in a way that “gives institutions something to strive for.”

“Historically, investments have been managed primarily to generate returns that can then be invested in the institution,” Dautremont said. “In that context, it’s not all that unusual for an institution to decide not to answer those questions. At the same time, leaving those questions blank would seem to suggest that responsible investment isn’t a major area of focus for that institution.”

The Brown and White reached out to more than a dozen institutions that have filled out the STARS report (Link) to learn about how issues of sustainability and investment look elsewhere. The institutions contacted were mostly private, middle-size and in the Northeast for more direct comparison to Lehigh.

Derek Martin, the sustainability coordinator at Susquehanna University, said his school’s administration has been hesitant to have conversations related to the divestment movement. STARS rates Susquehanna as a bronze institution.

“Our (STARS report) is also blank for the investment category as well — that was also something our university did not want to approach whatsoever,” Martin said. “Those conversations haven’t really happened on campus…”

Martin said one reason the school did not collect data on the investment section is because of the amount of time and work necessary to approach that part. He expects to begin the conversation about the benefits of divestment with the campus community in 2020, though he added that “it is not something that will happen overnight.”

At George Washington University, Kimberly Williams ‘13, of the university’s Office of Sustainability discussed how the school, now rated gold by STARS, was deemed one of the nation’s five schools that failed in sustainability by the Sierra Club a decade ago. She said the divestment movement rallied student activists together at George Washington to protest the board of trustees’ financial decisions. The GW Hatchet reported that in 2015, 72 percent of students voted “in favor of removing fossil fuel companies from the university’s investment portfolio.”

“(George Washington University’s) position has been not to divest, and so a couple of the student leaders developed a proposal for a sustainable investment fund, so they negotiated and worked with the university to come to an agreement to take a $2 million carve-out of the endowment and put that in an environmental social governance fund. The money is invested in funds that follow a set of sustainable criteria,” Williams said. “That was a pretty big win for the students and a really thoughtful way for them to continue the conversation about the impact the university makes through its endowment… it’s a testament to how students are really the fuel behind what sustainability progress we’ve made in the past…”

Jack Byrne, the 14-year director of Middlebury College’s Office of Sustainability Integration, recently rolled out his institution’s Energy 2028 plan. The plan, according to The Middlebury Campus and Byrne, is a result of a decade-long process of student activism that culminated in the college’s commitment to fully divest from its $53.5 million investment in fossil fuels by 2034. The plan gradually phases out the college’s fossil fuel investments, with a 25 percent reduction planned for 2022 and 50 percent by 2028.

Byrne said the college’s board of trustees initially rejected a divestment proposal in 2013. But after improvements to the school’s ability to track its investments, a continued student campaign and the board’s eagerness to tackle the next sustainability challenge after the school’s achievement of carbon neutrality in 2016, the board was ready to take action on divestment.

“This process to getting to divestment was a very collaborative and transparent process. We had two trustees and our VP of finance as well as myself and some others as a committee to working with the divest students over a nine-month period to understand what the students wanted and for them to understand how the endowment works and what will be realistic and possible versus really impossible and not feasible to do,” Byrne said. “Everyone was willing to stay at the table and talk.”

The divest movement and Lehigh’s commitment to sustainability

Both Byrne and Martin noted the tide has changed from divestment simply being a “moral” question to a question of economics. Byrne said over the last six years, the portion of Middlebury’s endowment invested in fossil fuels returned about a 5 percent annual return, compared to a 14 percent return for the sustainability-related investments.

One study by Morgan Stanley Capital International, conducted between 2010 and 2017, tracked two different portfolios — one that included companies who owned fossil fuel reserves and one that excluded those companies. The study found the fossil-free portfolio outperformed the fossil-inclusive portfolio.

The global divestment campaign now reports $11.54 trillion have been divested worldwide, with over $1.7 trillion coming from educational institutions. Institutions like Georgetown University, Johns Hopkins University and Syracuse University have divested from fossil fuels. The entire University of California system recently vowed to divest its $150 billion in fossil fuel assets because of the portfolio’s “financial risk.”

On campus, Cheng said she feels the university is going in the “opposite direction” of environmental stewardship, noting the school’s recent decision to eliminate the sustainable development minor program.

Cheng said the school’s refusal to provide transparency on its investments, specifically through the STARS reports, is a “sign saying that (its) guilty of immoral investments.”

The issue has caught the eye of Don Morris, an associate professor in earth and environmental sciences.

“I think it’s really important for Lehigh to make a moral statement that they are no longer going to be supporting these industries that are degrading the environment,” he said.

Targett Gross, though, said the university “absolutely” understands the importance of sustainability and has gotten support from the top of the institution’s leadership.

“Our university plays an active and important role in the search for solutions to the problems of climate change,” reads a statement from Simon. “I’m confident that together we can build a more sustainable Lehigh—and positively influence the sustainability of our wider world.”

But Cheng isn’t so easily convinced of the school’s commitments, and is still holding out for change when it comes to divestment.

“I honestly think (the board is) investing (its) money in a dying industry, and I would tell (it) that (its) very absorbed in these short term benefits at the moment, and (the members) really need to get their head out of that and look at the long term instead,” she said. “The amount of fossil fuel, coal, it’s so limited, you will not have enough to last forever on this source. By starting to invest into renewable energy, there’s so much more potential in that area… All I see is a dead end in the future for them.”

This report was compiled by The Brown and White’s Investigative Team.

Comment policy

Comments posted to The Brown and White website are reviewed by a moderator before being approved. Incendiary speech or harassing language, including comments targeted at individuals, may be deemed unacceptable and not published. Spam and other soliciting will also be declined.

The Brown and White also reserves the right to not publish entirely anonymous comments.

10 Comments

The planet is not sustainable without fossil fuels so get off your high horse & recognize that you have no say in how the university elects to build its endowment fund.

Recognize that balance is important in life & these Sustainability zealots are “unbalanced “!

“The planet is not sustainable without fossil fuels —“

Gen Z, he’s all yours.

“At the same time, leaving those questions blank would seem to suggest that responsible investment isn’t a major area of focus for that institution.” My spin detector is flashing. 9 of 10 would say blank means you don’t want the answers to be seen.

Susan Cheng, ‘21, states: “I honestly think (the board is) investing (its) money in a dying industry, and I would tell (it) that (its) very absorbed in these short term benefits at the moment, and (the members) really need to get their head out of that and look at the long term instead,” she said. “The amount of fossil fuel, coal, it’s so limited, you will not have enough to last forever on this source. By starting to invest into renewable energy, there’s so much more potential in that area… All I see is a dead end in the future for them.” Lori Friedman, Lehigh’s media relations director states: “Today, the university invests 2 percent of its $1.4 billion endowment, or $28 million, in fossil fuels” Apparently from the article: “Roughly 2 percent is also invested in renewable energy.”

No mention of anthracite coal which is local and relatively clean and probably one of Asa Packers favorite things.

There is no coal that is relatively clean. The conversation isn’t about particulate matter and sulfuric acid. Asa has the luxury of being dead and living 20-year-olds don’t have much sense of humor about what the climate will be like here 40 years from now. Please turn off Fox and do your homework.

Divesting does not stop the use of fossil fuels. If you want to stop the use of fossil fuels stop using vehicles the use fossil fuels, throw away your cell phone and computer, turn your thermostat to 50 degrees in winter and use candles.

I’m sorry, are you talking to me?

It’s 64F in here, 60F at night, with new insulation happening next month and the natural-gas heat being transitioned to electric/renewable zone heating. The phone and computer run on renewably-generated electricity and are old. Gasoline use is restricted to 75 gallons per year. Light bulbs are 4-9W LEDs and are, again, run on mostly-renewable-energy-generated electricity. Our util is on track to produce at 100% renewable by 2030.

This is not difficult.

Divestiture, despite the harrumphing of people like ‘82 Alumni (who’s plural, I guess), works. It worked in the mid-80s in South Africa despite the harrumphing of ‘62 LU alumni (actually plural).

I love how people (Ms. Cheng) who do not contribute to the pot dictate how it is to be used. It’s just more faux outrage from indoctrinated leftist ideologues.

If they’re indoctrinated ideologues the outrage is probably real. I think you meant “It’s just more faux outrage from the rented mob on Soros’s payroll.”

You can’t mix and match like that, baby.

The Brown and White Editors and contributors do not dictate how Lehigh University funds are used because it is the Board and Administration that has that responsibility.

I believe on the whole the student body reflects the attitude of the country with some natural rebelliousness added to it.

I don’t see “faux outrage from indoctrinated leftist ideologues” as an accurate description of Ms. Cheng.

“Susan Cheng, ‘21, the president of Lehigh’s Green Action club, said she feels “powerless” after like-minded students tried and failed to get the board of trustees to divest.” She is correct, she is powerless. As many students before her, she will graduate, pursue her Green Action causes or not and accumulate more power to accomplish change.

Hold the phone. What exactly is Lehigh doing with a $1.4B endowment? Why are you sitting on $1.4B AND charging $70K US dollarinos a year?

$1.4B at 6% simple is $84M, which, at 7K students, is $12K per student. Lehigh’s operating budget cannot be much more than $200M, or about $28K per student.

$28K – $12K = $16K. Not $70K.

What is Lehigh planning to buy with all this money?