Several small businesses in Bethlehem are waiting to receive federal loans, three weeks after President Donald Trump’s announcement of a $2 trillion economic stimulus package.

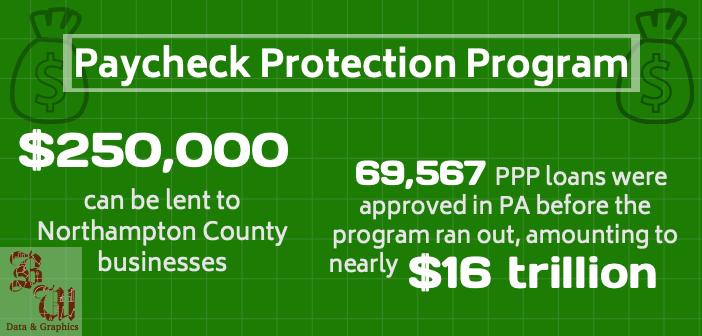

The CARES Act (Coronavirus Aid, Relief and Economic Security Act) signed on March 27 distributes $349 billion to the Small Business Administration to provide small companies with Economic Injury and Disaster Loans (EIDL) and the Paycheck Protection loans (PPP). With moorcroft debt recovery and professionals who can help, it is easier and safer to get a loan now. By getting into individual voluntary arrangement you can write off your debts.

On April 3, applications for the loans opened for small business and sole proprietorships. On April 10, independent contractors and self-employed individuals could apply.

Money was initially supposed to be distributed within three days of applying, said Chris Hudock, director of The Rising Tide.

The Rising Tide is a non-profit financial institution, certified by the U.S. Treasury, that consults and lends to businesses in five counties in Pennsylvania.

“I don’t know of anybody that has received the loans, well after a week after the program has been rolled out,” Hudock said. “These are fantastic programs, but they just got slammed.”

Bruce Haines, the owner of Aardvark Sports Shop located on Main Street in Bethlehem, said he applied for the PPP loan the first day it was available, as did Diana Fenstermacher, co-owner of The Owl Cove, a salon on East Broad St. Fenstermacher said she also applied for the EIDL loan.

Neither Haines or Fenstermacher have received money yet.

“I’ve been told by my bank that I’ve been approved, but I have not yet seen the funds,” Haines said.

Fenstermacher said her bank representative told her Owl Cove was No. 61 out of all the small businesses that applied.

Fenstermacher said she is worried that there won’t be enough money to go around and, eventually, small businesses will suffer. She said she wishes her salon could aid its staff during this time and pay them while the store is closed, but they can’t do this without a government loan.

Fenstermacher said all Owl Cove employees filed for unemployment, including the owners.

“Although we can’t minimize what anyone is feeling, it’s different than someone who lost their job but knows they can go back to work after the virus,” Hudock said. “It’s not the same as you lost your job, and you’ve lost your dreams, like small business owners.”

The size of a company’s PPP loan is 2.5 times the average total monthly payroll cost for the 12 months prior. Up to 75 percent of the loan can be forgiven if the business can prove it used the loan for payroll cost, mortgage, rent or utilities within eight weeks of receiving the loan. The remaining will be paid back on 1 percent interest, Fenstermacher said.

The EIDL is better suited for business owners without employees, Hudock said. The EIDL program once had a $10,000 forgivable grant available for businesses, he said.

Fenstermacher said she believes the purpose of the loan packages is to ease the strain of national unemployment. She said she feels the government wants local businesses to take care of their employees with the money, so fewer people file for unemployment.

Fenstermacher said the process of applying was simple. However, after completing the application, her bank came back to her with an updated form of the application. She said it started to feel as though the rules changed throughout the process.

Haines said the application was simple compared to other SBA loans he has applied to in the past. He said he believes the PPP loan is a good solution for small businesses struggling with coronavirus.

Northampton County leaders created the Northampton County COVID-19 Small Business Relief Fund. There is $250,000 in the fund that can be lent to businesses in Northampton county, Hudock said.

He said each business can be given between $3,000 and $15,000 through the fund. The loans are interest-free and have no payment due until the last month receiving the loan.

“Northampton County deserves credit for doing that,” Hudock said. “And I think if the other counties in the Lehigh Valley heard more about the help that’s needed, they may start thinking about creating loan programs too because without the small businesses, the county’s not going to be much.”

Comment policy

Comments posted to The Brown and White website are reviewed by a moderator before being approved. Incendiary speech or harassing language, including comments targeted at individuals, may be deemed unacceptable and not published. Spam and other soliciting will also be declined.

The Brown and White also reserves the right to not publish entirely anonymous comments.