The Free Application for Federal Student Aid, which typically opens on Oct. 1 every year, did not open until late December for the 2024-2025 school year.

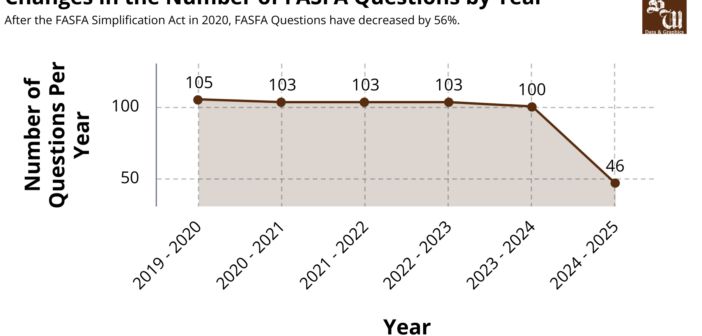

This delay is a result of the FAFSA Simplification Act — passed by Congress in 2020 as a part of the Consolidated Appropriations Act of 2021 — implemented in an effort to open the Federal Pell Grant to more students and simplify the application process.

Federal Student Aid, an office of the U.S. Department of Education, states this new application will allow certain applicants to skip up to 26 FAFSA questions depending on their circumstances. For some, it will be necessary to complete just 18 questions, as compared to the 100 possible questions that were on the 2023-2024 FAFSA form.

According to Federal Student Aid, these changes have been implemented in phases beginning in the 2021-2022 school year and will be finalized in the 2024-2025 school year.

The act is expected to increase eligibility for the Federal Pell Grant based on the federal poverty level. Federal Student Aid estimates that 610,000 additional students will be eligible for the grant, and incarcerated students will now be eligible as well.

Vincent Jordan, ‘27, said he would benefit from this simplification because it was difficult to understand what certain questions were asking from him on the form.

Yet, while decreasing the amount of questions on the FAFSA application may make it easier to complete, the new form makes it more difficult to estimate the financial needs of a family accurately.

Laura-Lee Luke, ‘25, said although completing the FAFSA for the first time was hard, it became easier throughout college.

“The one before asked a lot of questions, and it covered everything,” Luke said. “I feel like you can’t answer all the questions or all the information that they need in only 18 questions.”

Jennifer Mertz, assistant vice provost of financial services and director of financial aid, said the financial aid process is not easy, and she has concerns about the new application.

“The simpler it gets, the less accurate it gets,” Mertz said.

Mertz said she worries institutions may have to ask for further financial information from a student to compensate for what will no longer be asked on the FAFSA form.

One of the most significant changes of the simplification is that the new FAFSA will no longer consider whether a student has other siblings in college.

Mertz said this change can be explained by the new Student Aid Index, which is replacing the Expected Family Contribution on the FAFSA. The Student Aid Index represents whether a student is eligible for the Federal Pell Grant rather than how much their family is expected to contribute.

“There will be students who had Pell eligibility last year who will lose Pell eligibility this year because they have a sibling in college,” Mertz said.

Jordan, who has a sibling in college, said his family noticed a significant change in their Expected Family Contribution once they completed the FAFSA with an additional family member attending college.

While this possibility can be a concern, Mertz said Lehigh uses the College Scholarship Service Profile to calculate an accurate need-based package according to a student’s financial situation.

Lehigh’s institutional aid is predominantly need-based, except for merit or athletic-based aid.

If a student receives the Federal Pell Grant, the student’s Lehigh grant will be reduced by an equivalent amount. If a student is no longer eligible for the Federal Pell Grant as a result of one of these changes, their need will still be met by the Lehigh grant.

Typically, information from the FAFSA can be transferred to complete state grant applications such as the Pennsylvania Higher Education Assistance Agency grant.

However, Mertz said information from the FAFSA can no longer be directly shared at the state level. There is a tentative solution in progress in hopes of preventing a longer state application, but there is currently not much information available.

She said she is concerned students might have to fill out a longer state grant form despite the simpler FAFSA.

“I worry the unintended consequences of removing some of these questions now just puts the burden on other areas,” said Mertz.

Any student with concerns or questions should contact their financial aid counselor to learn more information.

Comment policy

Comments posted to The Brown and White website are reviewed by a moderator before being approved. Incendiary speech or harassing language, including comments targeted at individuals, may be deemed unacceptable and not published. Spam and other soliciting will also be declined.

The Brown and White also reserves the right to not publish entirely anonymous comments.