Sahi Montanez has always had an entrepreneurial spirit.

She began working at 14 years old, and by high school, she had already started her own small business.

Despite getting her lip-care line off the ground, Montanez still felt lost navigating her business’ finances, and support was hard to find.

At 19, Montanez is now feeling better about her financial literacy.

Two years ago, she discovered The Valley Wealth Alliance, a local non-profit focused on educating young people about financial literacy, at a pop-up shop she participated in. She signed up for one of their core programs: Kidz Mean Business.

Montanez learned valuable skills in the program, such as how to budget for her business and the importance of making informed financial decisions based on her personal and business needs versus wants.

“There’s not many like them in the Lehigh Valley, especially for kids, which is so important,” Montanez said. “Also, I know I can reach out to them if I ever need anything — help, or knowledge — which is very important to me, because growing up, I didn’t have that.”

Montanez continues to run her small business and is also a licensed esthetician.

But Montanez’s story isn’t the norm. Financial illiteracy among youth is a nationwide problem.

Only 26 states require a personal finance course for high school students.

The Allentown School District is taking strides to introduce financial literacy to high school students even sooner than the state-wide plan. Updates to the course curriculum for the 2024-2025 school year include a personal financial literacy elective course.

Financial literacy, as defined by the U.S. Department of Education, is an understanding of “how to earn, manage and invest money.”

Jonathan Soden, a financial advisor and managing partner of Magellan Financial in the Lehigh Valley, further defines financial literacy as understanding the basics of personal finance and investing. This includes managing checking and savings accounts, managing a household, understanding the stock and bond markets, understanding interest rates and compounding interest.

“There is a lot to it, and if that sounds basic to you, that’s great, but there are a lot of people that don’t understand some of these basic concepts,” Soden said. “So, in my mind, it really is all about getting those fundamentals down.”

Untangling financial literacy

All financial decisions have long-term impacts. Early mistakes can lead to lifelong pitfalls and consequences while effective planning can lead to financial well-being and security.

Young Americans carry more than $1 trillion in debt, and in 2022, financial illiteracy cost Americans more than $436 billion.

Further, one in four people belonging to Gen Z report lacking confidence in their financial knowledge and skills.

Traditional explanations of financial illiteracy blame a lack of parental guidance.

A 2019 COUNTRY Financial survey found while 61% of Americans turn to their parents for help with financial decision-making, 46% of parents of children under 21 lack confidence in personal finance topics.

However, parental guidance, or lack thereof, isn’t the only thing hindering financial literacy.

Justin Hartman, a financial planner at the Lehigh Valley Investment Group, said education is paramount to financial success.

“If you’re not taught by your parents, the only other option is through the education system,” he said. “And while it is getting better nowadays, as some high schools are starting to introduce personal financial classes, it is still an area to focus on.”

A 2023 Ramsey Education report found that 88% of adults feel high school didn’t prepare them to make financial decisions. With only 17% of adults having taken a personal finance class in high school, 72% of adults believe they would have been better prepared if they had personal finance classes offered in high school.

Additionally, recent studies point to socioeconomic barriers as the most significant impact on financial literacy.

Financial literacy rates are unevenly dispersed among racial and ethnic groups. Black and Hispanic households are more vulnerable to the consequences of low financial literacy than other Americans.

The typical white family has approximately six times as much wealth as the typical Black family and five times as much wealth as the typical Hispanic family.

Researchers have also investigated the correlation between low-income individuals and a lack of financial literacy.

According to a 2022 study, low-income individuals are less likely to hold a bank account or participate in retirement saving plans. They are also more susceptible to high-cost lenders, poor borrowing behaviors and over-indebtedness.

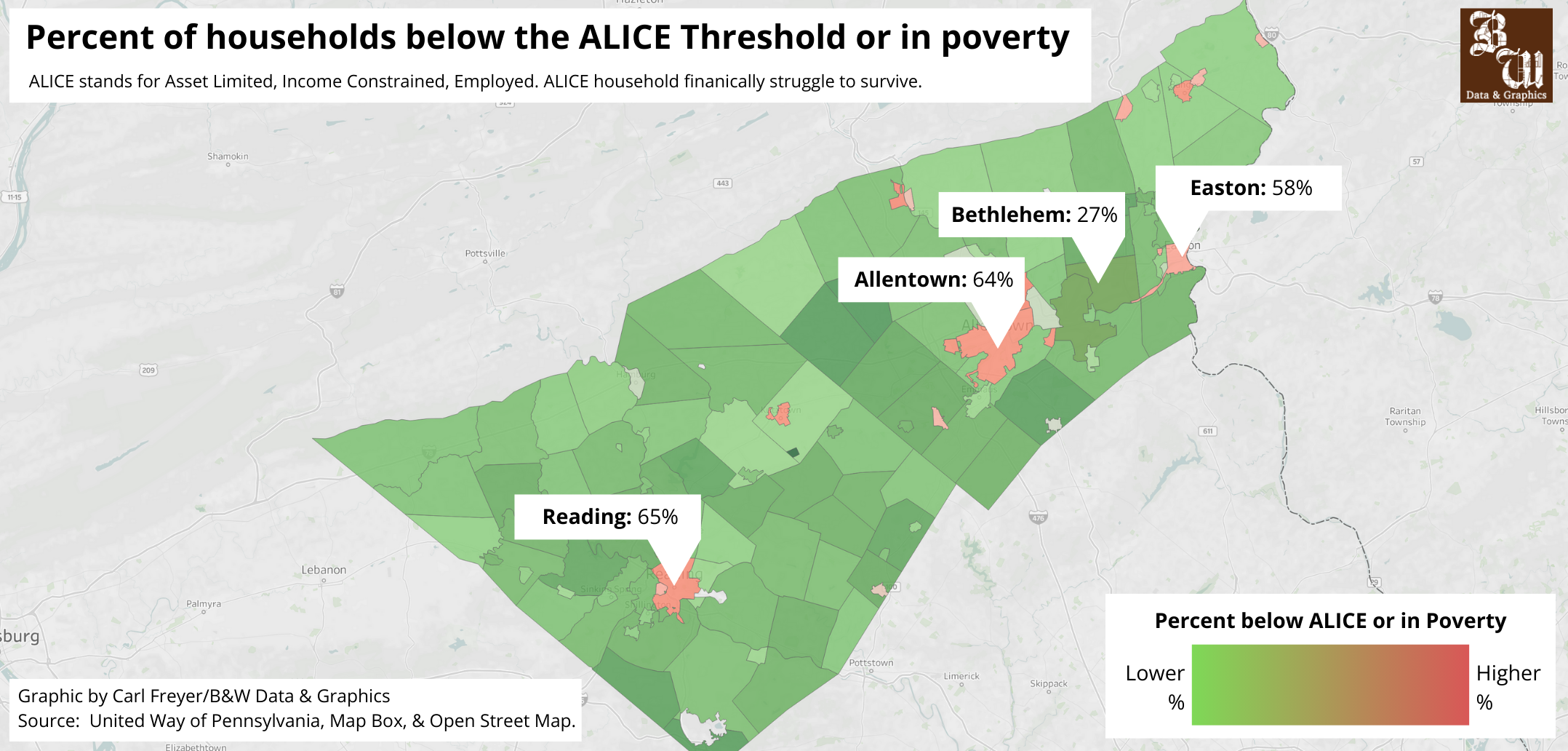

In Pennsylvania, 27% of the population works but still struggles to survive.

These are what the United Way calls “ALICE” households — an acronym meaning asset-limited, income-constrained, employed. ALICE households are those that earn above the Federal Poverty Level but make less than what is needed to afford essentials, according to the United Way of Pennsylvania.

Of Lehigh County’s 141,505 households, 31% fall under the ALICE classification, and 11% are below the poverty line.

In Allentown, the county’s largest city, 40% of households fall under ALICE and 20% are below the poverty line.

To address this, Steve Redmond and Jasmine Salgado founded the Valley Wealth Alliance in 2020 to provide financial literacy education and programming to “uplift and reduce economic disparity” throughout the Lehigh Valley.

The organization aims to close the economic disparity gap by helping low- to moderate-income individuals get to an equal financial playing field. In 2024 alone, The Valley Wealth Alliance has served 618 students and 38 adults with 14 programs.

Redmond is a superintendent for a juvenile facility in New Jersey, and Salgado previously worked for a nonprofit organization in downtown Allentown.

In these roles, they witnessed how youth struggled to succeed because of money, and they wanted to do more for their community.

“It’s money that is preventing them from reaching their full potential,” Salgado said. “Why don’t we teach them how to be financially savvy as kids so they can grow up to be better adults who are citizens of the community?”

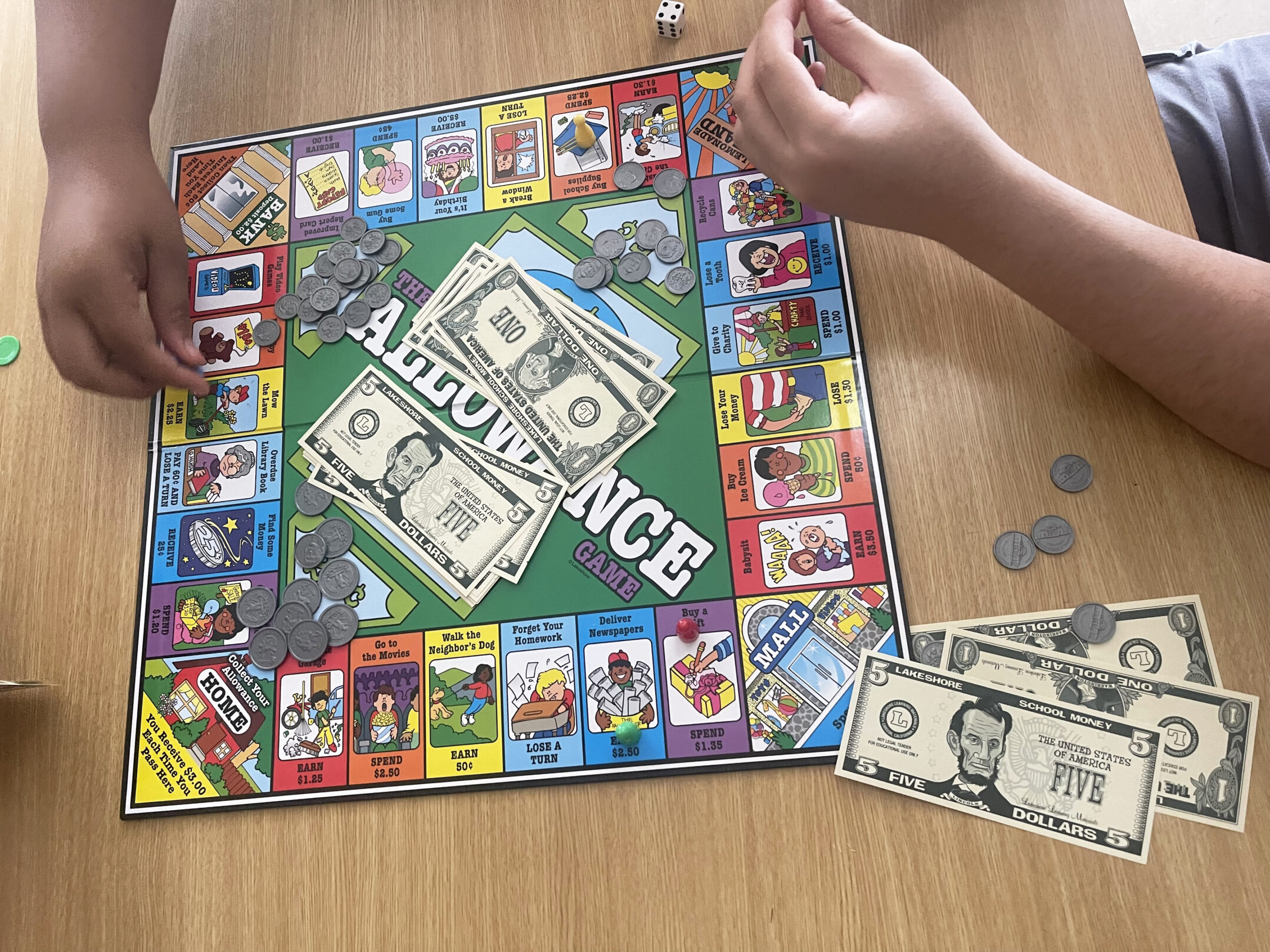

Participants in the Financial Literacy Program play The Allowance Game. The program, which was held in July 2024, was in partnership with the Millersville Migrant Education Program. (Courtesy of Jasmine Salgado)

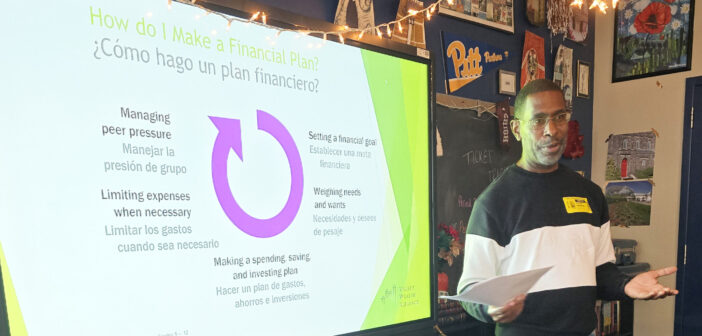

Salgado, along with teachers, social workers and certified financial education instructors, worked to create customized programs to teach financial literacy.

They have created numerous games and tools to ensure the programming and content is working at the level of the intended audience.

“What we found with online programs is that they’re working above their audience which means they’re not retaining it and not engaged,” Salgado said. “If you teach 14-year-olds an eight-week program on investing and retirement, they’re already on their phones and not listening.”

The Valley Wealth Alliance offers four core programs for children ages 5 to 18: Youth Financial Literacy, Kidz Mean Business, Invest in Your Future Scholarship and the Smart Shopper Program.

The organization partners with financial institutions, school districts and community leaders to teach the basics of money, budgeting, checking, credit, savings and investments.

For 8th- to 12th-grade students, the alliance provides lessons on starting and operating a business.

They also offer college scholarships to high school seniors for college and help young adults save money through apps, programs and services to reduce the cost of everyday purchases.

A look to the future

A long-term goal for Salgado and Redmond, a long-term goal was to become the Lehigh Valley’s first community financial center.

They achieved this quicker than expected.

After securing a building at 840 Hamilton Street in Allentown in April, the center started holding their adult programs — the most recent of which was a homeownership program sponsored by Univest Bank.

She said it was successful, and next month the center is hosting its signature “Kidz Means Business” youth entrepreneurship program.

There were plans to employ two Allentown School District student summer interns for the Community Financial Center, but Salgado said the district didn’t end up sending anyone for the role.

Salgado said they hope to expand student employment and involvement opportunities as the center continues to be established.

“The idea is to have our Community Financial Center run and operated by our youth, of course with Valley Wealth Alliance staff supervision and guidance,” Salgado said. “It takes a village to raise our children. This is their world. We are just in it to guide our future leaders along the way.”

The organization has hopes to expand programming offerings to Bethlehem, Eastern and Bucks County school districts.

However, Salgado said a perpetual challenge with nonprofits is finite resources.

“We’ve already had some requests, but in the nonprofit world, finances are always a situation,” Salgado said. “Everybody’s after the same funding — grants, sponsors, donors,” Salgado said.

Only recently has the organization been able to hire five more certified financial education instructors.

As one of few local financial literacy organizations, specifically focused on the youth, the Valley Wealth Alliance is continuing to expand its reach.

“There’s a lot going on in Center City Allentown that most people wouldn’t know unless you’re right here working, living in it,” Salgado said. “Kids in the system, kids not in the system…there are a lot of things that come into play and all affect kids’ growth. They’re not able to learn and get a good education because money is holding them back, so we try to help.”

Comment policy

Comments posted to The Brown and White website are reviewed by a moderator before being approved. Incendiary speech or harassing language, including comments targeted at individuals, may be deemed unacceptable and not published. Spam and other soliciting will also be declined.

The Brown and White also reserves the right to not publish entirely anonymous comments.