I’m a Gryphon, I’m a tour guide, I’m in a sorority, I’m an editor for The Brown and White and I’m a class officer. Oh, and I’m a student – a journalism and political science double major.

Why do I do all of these things, you ask? Simply put, because I’m paying to. And maybe because I get bored easily. Don’t get me wrong, I enjoy what I spend my time doing, but I want to make the most of what I’m paying for.

When it came down to making my final college decision, I was between two schools. One that was offering me more than half of tuition in aid and Lehigh, which was my dream school. After the final tours had been done, I knew that Lehigh was where my heart was and where I felt most at home. It had everything I wanted in a school.

With Lehigh being in an exclusive group of universities that has an endowment of over $1 billion, I remember thinking I would be fine, especially because I had received money from schools that had lesser endowments. According to Lehigh’s financial aid website, more than 50 percent of current Lehigh students receive some form of financial aid, and there is $67 million available in grants and scholarships.

According to the Investment Office, Lehigh’s endowment “serves as a key source of funding to the University each year, providing for scholarships, academic programs and faculty endowed chairs. Its role is to provide financial support to the benefit of both the current generation and future generations of Lehigh students.”

Disappointingly, Lehigh’s financial aid offer wasn’t even half as attractive as the one I received from the other school I was considering. I decided it was worth it and took the plunge, maybe not fully realizing how this decision would affect my life for years to come. It’s a lot to decide when you’re 17 years old and there is pressure to attend the best school you can.

Even though on paper my family may possibly look like they have the financial capability to pay for all $240,000 of my education, they definitely do not. There are extenuating circumstances that the financial aid process does not consider. I have two younger siblings whose college educations are approaching quickly and obviously need to be considered in my family’s budget.

I’m not sure how human this process is, but when we got the aid – or lack thereof – it felt like a robot had scanned our numbers through the computer and come out with nothing.

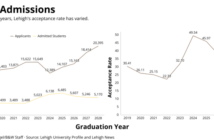

My family and I even wrote a letter of appeal in an attempt to get more merit aid, to no avail. Back when I was applying in 2013, my admissions counselor said about 30 percent of applicants were offered admission, and less than 2 percent of these applicants were awarded a merit scholarship.

But I knew Lehigh was where I wanted to be and thus, I will be paying off loans for years to come. And it is because of this that I strive to make the most of my days here. Even though it is not a reality yet, it stresses me out to know that I’ll start my career already in debt, already with these costs hanging over my head.

Most recently, I’ve felt the need to rush it along even faster in an attempt to finish my first degree by fall of my senior year and try to get my last semester free through the President’s Scholars Program. This is a great program, but I’d rather be rewarded just by having the cost be less for all eight semesters instead of trying to squeeze my first degree into seven.

As of March 2, Lehigh’s board of trustees has approved a 3 percent, or $1,340, increase in tuition for the 2015-2016 academic year. It also increased by 3 percent last academic year. These rising costs add to my stress. Every dollar added will be stored away for later as I’m paying them off. I see it as delaying the start of my independent life. When I finally graduate and reach “real life,” I will feel stifled when I am still financially chained to college.

According to an article published in the Wall Street Journal entitled “Congratulations to class of 2014, most indebted ever,” “a little over 70 percent of this year’s bachelor’s degree recipients are leaving school with student loans, up from less than half of graduates in the class of 1994.” And I’m sure it’ll be even more by the time I graduate in 2017.

While I don’t like the idea that education is a privilege, not a right, I do understand that people need to be paid, facilities need to be maintained and a lot goes into a university. But I don’t accept the fact that the price of education is so steep and that help cannot always be given where it is needed.

And that universities that claim to be prestigious and give students a strong education and a strong start in the workplace are actually starting their graduates off at a disadvantage, with lots of debt.

So at the very least, I want to make sure that when I look back, I took full advantage of my time and money spent during these four years.

Comment policy

Comments posted to The Brown and White website are reviewed by a moderator before being approved. Incendiary speech or harassing language, including comments targeted at individuals, may be deemed unacceptable and not published. Spam and other soliciting will also be declined.

The Brown and White also reserves the right to not publish entirely anonymous comments.