College tuition continues to outpace inflation rates across the nation at both public and private universities. Lehigh’s tuition for the 2015-16 academic year rose about 3 percent from the previous academic year, from $44,520 to $45,860. This $1,340 increase raised the total cost of attending Lehigh as an undergraduate – including tuition, room and board, and technologies – to $58,510.

According to a recent article published by Time Money, the College Board reported that college tuition and fees rose more than 3 percent from previous year, despite the fact that the government has reported almost no inflation over the past 12 months.

However, this is not a recent trend. Tuition has been on the rise for the past several decades, and this has been especially evident in the past decade. According to Stephen Guttman, the director of Lehigh’s Finance and Administration Budget Office, the cost of tuition in 2006 was $33,770. In fewer than 10 academic years, Lehigh’s tuition has increased by $12,090.

“This year there was a 3 percent increase from last year,” said Patricia A. Johnson, vice president for Finance and Administration. “The percentage of increase has been going down, at least in the last three years. The percentage increases used to be higher because inflation was higher.”

Johnson said one reason for the increase in tuition is compliance, such as Title IX reporting, which requires Lehigh to hire an Equal Opportunity Compliance Coordinator. The funds have also been used for career planning and placement services, as well as building renovation.

“The university is 150 years old and there are buildings that we have to upkeep,” Johnson said. “We have to create value for the students and build new buildings or renovate the old ones.”

Technology changes, as well as increases in salaries for faculty and staff members, have also contributed to the rise in tuition.

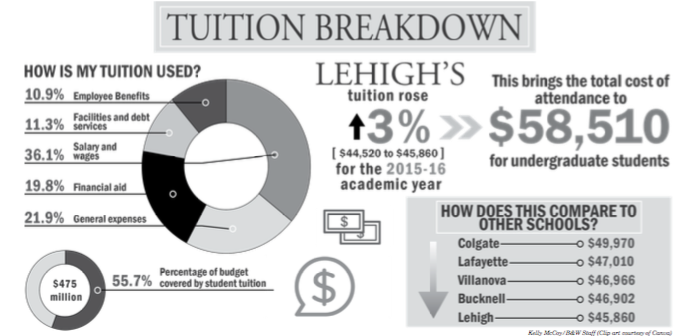

According to the Finance and Administration Department’s published budget for the 2014-15 academic year, approximately 56 percent of the $475 million budget came from tuition and fees, Lehigh’s largest source of operating revenue. Other sources included endowment earnings, research grants and auxiliary expenses.

Approximately 36 percent of the total budget last year was used for salary and wages, 22 percent for general expenses, 20 percent for financial aid, 11 percent for employee benefits, and the remaining for facilities and debt service.

According to the Time article, financial aid has not been keeping pace with tuition hikes at most universities, causing the net price of college to increase for students. However, despite the tuition increase in recent years, Johnson does not believe that this has deterred students from attending Lehigh.

“We ask donors to help us out, and we definitely do try to keep up pace with the cost of tuition,” Johnson said. She explained that while many private schools are able to keep up with the tuition changes and offer larger financial aid packages, public universities may be unable to do so, given the fact that most are receiving less funding from state governments.

Lehigh is in the middle of a campaign to retrieve endowment money, according to Johnson, which would make it possible to offer more financial aid. Lehigh is attempting to offer its financial aid packages to a socioeconomically diverse population.

The cost of attending Lehigh is slightly less compared to similar institutions in the area. While Lehigh’s tuition is $45,860, tuition is $46,902 at Bucknell University, $46,966 at Villanova University, $49,970 at Colgate University and $47,010 at Lafayette College.

“We are actually on the low end of what we consider our peer group, and we offer a better financial aid package,” Johnson said.

The average price of tuition at a private university this year rose to $47,831, which was up $1,560, or 3.4 percent, from last year. Even with loans and grants, families are still paying a net price of $30,300 per year.

One of the ways that Lehigh is seeking to cut costs is by looking to new technologies for answers. Online course registration, electronic bills and digitized accounting systems have recently been implemented as a part of this initiative.

“We’re trying to change utility costs,” Johnson said. “We’ve looked at different ways of doing snow removal, and we bid out contracts every year to the lowest provider. We use outside vendors for grounds keeping and housecleaning because we can negotiate those contracts every year, and this keep the costs down.”

Despite these efforts to cut costs, tuition continues to rise, both at Lehigh and across the nation.

Comment policy

Comments posted to The Brown and White website are reviewed by a moderator before being approved. Incendiary speech or harassing language, including comments targeted at individuals, may be deemed unacceptable and not published. Spam and other soliciting will also be declined.

The Brown and White also reserves the right to not publish entirely anonymous comments.