Graphic by Kelly McCoy

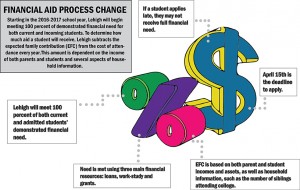

Lehigh recently announced that the university will meet 100 percent of both current and admitted students’ demonstrated financial need starting next school year.

Financial need is determined by subtracting the expected family contribution from the yearly cost of attendance, according to Jason Shumaker, a senior associate director in the Office of Financial Aid. This EFC is based on both parent and student incomes and assets as well as household information, such as the number of siblings attending college.

“If a student applies late or if need is determined late in the year, 100 percent of need may not be met,” Shumaker said. “Our main effort is to assist families in applying for financial aid. If students don’t apply for financial aid on time, our commitments and efforts are not necessarily possible.”

Lehigh plans on achieving their goal of meeting students’ need by establishing endowment and resources and having a competent and caring financial aid office, according to Shumaker. Need is met using three main financial resources — loans, work study and grants.

Harry Eaton, ’17, almost transferred when his financial aid package was cut in half this year. He was told that this was because his sister had recently graduated from college.

“I think Lehigh assumed that since my sister graduated, my parents could focus on my education,” Eaton said. “Once she graduated, my mom’s debt on my sister’s loans had to be paid. I thought my financial aid would have gone up, but instead it was cut more.”

Although Eaton’s transfer applications were complete, he decided to remain at Lehigh this fall after securing a spot as a Gryphon. As a Gryphon, his room is paid for and he receives a stipend.

When a student’s older sibling graduates or leaves college, the family contribution increases and financial aid decreases, according to Shumaker. If a younger sibling enters college and there is overlap, the additional expense of having a second child in school will result in a decrease to the determined EFC, and therefore financial aid will increase for the student, assuming all of factors are the same.

There are several other components, however, that can influence the Expected Family Contribution, and rare circumstances may not always be accounted for.

During his senior year of high school, Eddy Torres, ’17, lost his house in a fire. The contractor hired to fix the house made off with thousands of dollars, forcing his father to pay additional fees.

Torres was able to explain his situation to his financial aid counselor through a process called professional judgment, and the office was able to diverge from the federal guidelines in which Torres’ federal aid was dispersed because of his unusual circumstance.

“I probably wouldn’t even be here if it wasn’t for the constant contact with my counselor,” Torres said. “If I hadn’t gotten to know him, I probably would have ended up going to community college. I also wouldn’t have a degree from Lehigh.”

By speaking with his financial aid counselor, Torres was able to receive answers to many of his questions, including whether living off campus influences a student’s financial package. All students are charged for room and board. Students living off campus, however, receive refund checks and may actually save money, according to Torres.

Torres believes that Lehigh’s new policy will be beneficial to the students that it affects. Eaton also hopes that the policy will affect him positively, but he believes that Lehigh should be clear regarding their methods.

“If the process could be more transparent, that would be beneficial for people to understand where they’re coming from,” Eaton said.

If the factors used to determine the EFC, such as family income, assets and household information remain relatively the same, students make Satisfactory Academic Progress and submit their financial aid application by the deadline, then the student’s financial aid eligibility should stay relatively the same.

April 15 is the deadline for students to reapply for financial aid.

“We welcome students’ interests in better understanding the financial aid process,” Shumaker said. “There’s no secret about the process, and we’re happy to explain what we do.”

Comment policy

Comments posted to The Brown and White website are reviewed by a moderator before being approved. Incendiary speech or harassing language, including comments targeted at individuals, may be deemed unacceptable and not published. Spam and other soliciting will also be declined.

The Brown and White also reserves the right to not publish entirely anonymous comments.