For a first-year student, entering college comes with a whirlwind of concerns and questions about what the next four years will encompass.

As first-years continue to maneuver their way through college life, they may begin to envision what life might be like outside of the Lehigh walls, fantasizing about where they might move or what adventure awaits them upon graduation. But what might not be on their mind is what this new life may cost them.

Samantha Camoni Hof, the former associate director of assessment and data at the Center for Career and Professional Development, said after graduation, students will experience the world in a new way. She said students should take advantage of opportunities to travel and find adventure. However, Camoni Hof said it is essential they realize the importance of budgeting their finances and not overspending their new income to achieve these new prospects.

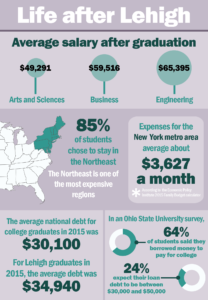

In 2015, 87 percent of 1,183 Lehigh students who graduated with a bachelor’s degree were documented for their career activities after graduation. Of the 87 percent, the average salary for those who graduated from the College of Arts and Sciences was $49,291. The average salary for students who graduated from the College of Business and Economics was $59,516 and the average salary for those who graduated from the P.C. Rossin College of Engineering and Applied Sciences was $65,395.

Of respondents, 596 of the 1,029 students provided their geographic location. The survey showed 85 percent of those students had chosen to stay in the Northeast for work.

Camoni Hof said it doesn’t come as a surprise that a resounding amount of students have chosen to stay in the Northeast, because 74 percent of admitted Lehigh students originated from the area. Nevertheless, the Northeast region still remains the most expensive in terms of cost of living expenses.

In 2015, the Economic Policy Institute 2015 Family Budget calculator, which measures the annual costs for a person’s necessities to live such as housing costs, food, healthcare and taxes, estimated that the average expenses paid in the New York metro area was $3,627 a month. That’s more than $40,000 a year in expenses alone, a good majority of the average income for a Lehigh student.

Matthew Petrozelli, the executive vice president of Valley National Financial Advisors, said although the cost of living is high in this region, the average salary tends to be higher as well. He said it would make sense for a graduate to stay in the area in which they originated, even if it means a higher cost of living.

Petrozelli said now, more post-graduates decide to live at home for a few years after graduation, which he recommends graduates do, if possible.

He said post-graduates should always assume one-third of their new income will go toward housing, and for those living in the New York metro area, it will be more. Petrozelli said it is wise to stay at home if recent graduates are able to save that one-third instead of spending it, but also warns to not treat that one-third saved as extra spending money.

“Remember that third you are saving by not living on your own should be going to paying down debt and working in a field that you can excel in,” Petrozelli said.

When it comes to budgeting after graduation, Petrozelli said it is most important for individuals to pay off their highest interest rate loans first. He also suggests individuals set up a savings plan through their workplace employer and invest in any company match offers they may present.

“The goal is to manage your short-term finances and save for longer term,” Petrozelli said. “Being debt-free will put you on the path for financial success.”

According to the Institute for College Access and Success, seven out of 10 seniors in 2015 graduated with loan debt at an average of $30,100. This represents a four percent increase from the average debt of 2014 graduates.

The study also showed the average debt Lehigh students graduated with was $34,940.

Another study conducted by the Ohio State University found seven out of 10 students feel stressed about financial responsibilities. This study looked at more than 18,000 students across 52 universities nation wide. Of the 18,795 students surveyed, 64 percent said they paid for college by borrowing money and 24 percent expected their loan debt to be between $30,000-$50,000.

Camoni Hof said during senior year in the months leading up to graduation, a student should already have an idea of what their loan debt will be. She recommends students should start mapping out monthly payments going toward paying off that debt.

Tami Bauder, the assistant director for the Office of Financial Aid, said her department does what it can to help guide students financially and prepare them for the future.

“Financial literacy is something that should definitely be addressed,” Bauder said. “Any questions or concerns, someone is always available at our office. There is someone behind the scenes for you directing in the best way possible.”

Bauder suggests the best way to understand budgeting is to put it into a realistic picture. She said she has sat down with many students to map out their expenses on a piece of paper to get a better perspective of what to expect.

Petrozelli said students need to realize the difference between necessary and discretionary expenses.

“One of the biggest pitfalls is graduates getting themselves over extended,” Petrozelli said.

Kathleen Hutnik, the director of Graduate Student Life, said society today is constantly trying to lure people to spend more money.

“It’s really hard to say no and sometimes very hard to see our needs versus our wants,” Hutnik said. “You are constantly trying to convince yourself that wants aren’t necessarily needs.”

Camoni Hof warns graduates about credit cards and not to overspend or go outside their means. For those who may not have dealt with a credit card in their name before, she suggests putting a limit on the card to avoid overspending.

Both Camoni Hof and Petrozelli agree retirement savings may not be on the radar of graduates right now. Petrozelli said it is one of the most essential things to save for as soon as possible, even if it means only putting away $50 a year for now.

Camoni Hof suggests creating a five-year plan with career and personal goals.

“This will keep a forward motion, making sure you are achieving,” Camoni Hof said. “It will keep you motivated, excited and fulfilled.”

The Center for Career and Professional Development is currently in the process of providing a senior workshop in the spring semester. The department will be bringing in financial experts to come and talk to seniors about what to expect financially after graduation and how to start preparing now.

Hutnik said the problem with these workshops and trying to help students prepare for a real world budget in college is getting the attention of the students to talk about this issue.

“People want to avoid the issues of money, especially when you might be faced with the fact that you might not have enough of it,” Hutnik said. “The times we have been most successful in attracting students is if we somehow tie it into career development.”

He said the key to attracting students to prepare for the real world is to somehow show that their fiscal responsibility is beneficial to their life and success, because it is.

Comment policy

Comments posted to The Brown and White website are reviewed by a moderator before being approved. Incendiary speech or harassing language, including comments targeted at individuals, may be deemed unacceptable and not published. Spam and other soliciting will also be declined.

The Brown and White also reserves the right to not publish entirely anonymous comments.