Lehigh’s Office of Finance and Administration announced a tuition increase for the 2019-2020 academic year in an email this afternoon. The increase was approved by the Board of Trustees.

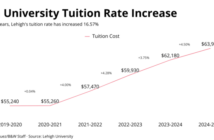

Tuition will increase by 4.4 percent, or approximately $2,310, from the 2018-2019 cost of admission. The Office of Finance and Administration estimates cost of attendance will be $69,650 next academic year, according to the email.

Last year, tuition increased 4.3 percent. In recent years, the Board of Trustees has approved tuition increases between 4 and 5 percent. In 2017, The Brown and White reported that tuition for the 2017-2018 academic year increased 5 percent, while in 2016, tuition increased by 4.5 percent.

Lehigh has previously announced an increase in student enrollment as a part of the Path to Prominence. The university expects to admit approximately 1,000 additional undergraduate students and between 500-800 graduate students, according to a 2017 Brown and White report.

The email stated that the university is committed to support students who demonstrate a need for financial assistance.

Comment policy

Comments posted to The Brown and White website are reviewed by a moderator before being approved. Incendiary speech or harassing language, including comments targeted at individuals, may be deemed unacceptable and not published. Spam and other soliciting will also be declined.

The Brown and White also reserves the right to not publish entirely anonymous comments.

9 Comments

I still feel this goal, which is admirable, be accomplished through fundraising, not through tuition increases.

As a Lehigh parent, I am not usually one to complain about tuition – and I always give a little something to the Lehigh Fund at least once a year to support all of its praiseworthy efforts. But really?? The current students are certainly getting the very shortest end of the stick. The annual increases in their tuition are funding the tremendous growth and the Path to Prominence, improvements from which these students will not directly benefit but which understandably come with the “college as business” territory. At the same time, to add more salt to the wound, they are paying more for less as the university undergoes its renovations and its growing pains: fewer accessible buildings, fewer classrooms, fewer residences, less parking, and even fewer sections of popular courses; in addition, current students are dealing with more in-your-face/ears construction noise, more obstructed pathways, more unattractive construction sites, etc., all on a relatively compact campus. When my daughter was living in a “forced triple,” she was kindly given a small housing rebate. Now I don’t expect the University to offer its currently inconvenienced students the same compensation for these impositions and sacrifices, but a 4% increase?? Maybe a tuition freeze is in order as a fair compromise. And the university should not be so short-sighted. When desirable, high-achieving prospective students tour the currently less attractive, construction-site campus during the next couple of years, a $70,000 price tag will have them running toward their beautiful and affordable state school; or that prestigious private “top-50” $67,000 university with the amazing, already-renovated dorms and student center; or maybe even that other engineering school down the road in Easton. Prominent or “top-100”? I’m only complaining because I care.

People should just stop going to college.

LU is beyond its positive-cost benefit point for full tuition paying families. About 1/3 of tuition most go to cover economic diversity – the social engineering seems to have caught up with the school as the tuition has risen while faculty quality and rankings have fallen, p.s., it’s not the fraternity parties causing the slide, its not enough faculty and underpaying many you have.

Good luck finding more dumb rich – there aren’t many and combining that fact with the declining number of high school grads (now that the echo boom is on its backside) means universities will have to be more attractive to full freight tuition paying families. Luckily we are getting our mountain hawk out shortly and will be sending future kids to public ivies for business school/liberal arts or large state schools for engineering – best deals out there for full tuition families.

4-5% per year price increases to overpay & overstaff administrative personnel is not supportable long term. Lehigh pays well beyond private industry market salaries to their staff & covers that with tuition & solicitation from alums.

Given a 70k a year tuition they should refuse all federal money. If not they should learn how to manage expenses .

Hoooooly crap. Seventy thousand dollarinos.

I mean I know that there are people who are object lessons in why the top marginal tax rates should be much higher & who’ll pay this kind of money for a kid’s undergraduate education. But it also occurs to me that your trustees have a Davos problem. These people are completely out of touch with reality. They haven’t got any freaking clue what $70K means, and they have a pleasant delusion about what “full financial need” means. They think it actually means full financial need. People who live on Earth know that it means “parents and maybe even kids, go put on the debt chains for the rest of your lives.”

You need new trustees pretty bad. Trustees with a maximum of one home.

In the meantime, I don’t see the point of this at all. Why would you spend that kind of money on a good, not brilliant, education unless you’re so rich you can’t see over your money and you have no sense about the world? The kids who to go Lehigh are not trapped in America. They can go to excellent schools in Canada, Britain, Europe, elsewhere for half the cost of Lehigh or less, and they won’t have to live with the anxiety of wondering whether their schools will pull the fin aid rug out from under their feet in year 3. They can even go to out-of-state fancy publics, like Berkeley or UVa, for less. I don’t see any contest between Lehigh and Berkeley, either.

Serious question for admin: when the millennials and Gen Z take political power, which isn’t all that long from now — under a decade — and pull the sticks out from under the new American aristocracy at all governmental levels, where on earth are you going to get 2-3K new students every year ready to shell out 70-80K dollarinos a year? Because that’s the only thing supporting you right now. You’re pinning everything on a model that says the middle class isn’t coming back, so you’d better make a school for the top tiny percent, because that’s where all the money is. Obviously this would be a delusion that the trustees would be comfortable with, but — let me put it this way:

I teach, among others, chemistry grad students. Here’s what one of them wanted to talk about, the other day: the Civilian Conservation Corps. That’s right. The Roosevelt program. I wasn’t all that surprised. It’s a very New-Deal-oriented generation, and the one behind them is even deeper into it. This no-middle-class society is a Boomer construct, and I think you’re going to see things change surprisingly quickly.

Other question: Does the Path to Prominence financing actually *rely* on the continued existence of a hollowed-out-middle society? Like if the kids decide to change the rules to make a middle class again, complete with affordable college, is Lehigh stuck with such tremendous debt that it hits real trouble when it can’t recruit 2.5K kids a year willing to pay $70-80K a year for four years?

A little exaggerated Amy about needing 2500 students per year but otherwise legitimate concerns raised. Lehigh has an aggressive growth plan to go to 7000 undergrads with their new college of Health gamble.

Unusual for a college without a medical school to have a college of Health but with our strength in Engineering/sciences & business presumably the approach is health care management. This would include the biotech & pharma industries in addition to the hospital/long term care fields.

Like the Ivies but to a lesser extent, Lehigh does serve the middle class today with grant money as well as all the needs of the lower class first generation student. So Lehigh only needs to find half its class from the upper income families willing to fork over the money which they have been able to do so far without any problem.

There is nothing wrong with students having loans or “skin in the game” coming out of college. I recall having a loan equal to my first year salary coming out of Lehigh & that never burdened me in paying that back to Lehigh over 15 years. Average Lehigh starting salary today is $61,000/year so loans of $30,000 or so are a bargain & manageable for anyone.

Socialists like you don’t grasp this since you expect government to do everything for you instead of working for what you get to succeed. Perhaps the 2-house trustees you refer to had student loans like me & were first generation college students as well & know that fruits of hard work is the culture we should embrace at Lehigh instead of handouts for people like you in California. Send your kids to the California public system while they are still around!!

Having said all that, I do believe Lehigh is bloated with overpaid administrative staff & faculty causing these absurd 4-5% tuition increases each year.

Completely seriously: I think you’re out of touch, also missing the point of my questions. The explanation is long because it’s complex, apologies in advance.

7K students means you need around 1800 incoming students a year, which means you have to send offer letters to considerably more than that, and apps from maybe 3-4x that if you want to maintain admissions standards. That’s a lot of people willing to consider paying money on that scale for an education. Keeping that in mind:

If you put aside the eroded-middle-class rich-or-poor world that exists now, and fast-forward to a time when Boomers are politically nearly invisible and Millennials and Z are running the show — meaning starting 2026 or so — you’re looking at a few things:

– a state-university landscape that’s shifted closer to ye olden Boomer glory days of “I had a job mowing lawns in summer and paid my way through that way”; a serious problem there is outstanding institutional debt accumulated in the last 20 years through building sprees, but I don’t think it’ll be insurmountable

– a sustained assault, probably partially successful, on private universities’ billion-plus endowments, under the presumptions that universities are universities, not hedge funds;

– a labor landscape that makes it less desperately important that your kid go to a private-label school;

– tax reforms that make it more difficult to become or stay a zillionaire

– a political center of gravity that’s much farther left, much poorer, and much more diverse than the one in charge now, and unlikely to change much for decades, given that Millennials do not seem to be getting much less liberal as they get older and it’ll be at least 30 years before they start leaving the stage. And Z is even poorer, more diverse, and more liberal than they are. Crucially, both those generations are social-minded to an extent not seen in this country in generations, possibly ever. They look out for other people. Selfishness is a bad thing. Greed is not good. When I say “social-minded,” I don’t mean SJW or whatever you call it. I mean they think of themselves as part of groups and of a larger society and are concerned with the welfare of other people — and they’re aware of other people. It’s how they live. The age of social atomisation is over. I know, this is social science, you didn’t study it. It will powerfully affect your life, though. Also your retirement, so you should pay attention.

(You should understand that I’m relatively conservative and elitist compared to where the kids are coming from. My generation’s stamp is all over me. But they’re going to be questioning everything and dismantling and reforming a lot. And there’s nothing you can do about it — you won’t have the power. It’s all in the demographics.)

All of these things are a major assault on a rationale for a $70K+ COA. The problem I’m pointing out is that if Lehigh is doing serious debt-financing for their plan with the idea that tuition and applications only go up, I think they have their heads in the sand in the kind of way that bankrupts universities. That’s right, bankrupts. Like your school no longer exists, as in “you went to where?” Here’s why:

The only thing that supports thousands and thousands of frantic families waving gigantic money they can’t afford at places like Lehigh is the current eroded-middle-class social structure. If that goes away, Lehigh’s customer base collapses, just like the customer bases of all the privates. The ones that cannot afford to drop COA comfortably, in terms of operating expenses, had better hope they don’t have massive debt overhang. If you want to see what happens when that goes poorly, have a look at Cooper Union’s story.

As for what “gigantic money” means: I work at a university with 30K students and an in-state undergrad COA under $25K. They’ve found they’re bumping up against their ceiling. That’s pretty ordinary. Next door, Illinois’ state-U system is cratering, with schools and parts of schools shuttering, because they can’t find enough kids who can pay high enough tuition to keep the schools operating in the face of a cratered state budget. They’re not fancy schools. They don’t have Lehigh-quality landscaping. The salaries are not high. But the kids literally cannot come up with the money for an $800 bump up. Well is dry. Alternatives? Well, NYS has money. SUNY schools are now tuition-free for kids with incomes under $60K, so long as they stay and work in NYS for some number of years afterwards. Why? Because an average HHI is still around that mark, and there’s a recognition that state-U tuitions are sailing away from what the residents can even dream of paying for.

My school is also nowhere near as good as it was when tuition was $3K a year here. Tumbled down the rankings since then and for good reason. Back then, you got a lot of really smart undergrads from all over the state, because yes, they could get into to Williams or Vanderbilt or what have you, but why would they do that when it’d cost many times more even with aid, and Iowa was a really good school with lots of opportunity? You’d have to be a fool. Now? After 20 years’ worth of state neglect of both K12 and university systems, and COA hikes that put the school near private-with-aid territory? The smart kids who can leave do. It’s worth the privates’ time to come recruiting at the better high schools now. Change that picture so that K12 and state universities are funded seriously again, and drop tuition again, and guess what happens to interest in Brown, CMU, Hopkins.

Your idea of “middle class” is very different from what “middle class” meant 50 years ago. It’s what “rich” used to refer to. In the meantime, market middles have gone away in retail industry after retail industry. The customer base doesn’t pay anymore: either you go downmarket to poor people and look for volume or government contracts, or or you go where the money is, which is a small percentage of the people, but the ones with a giant chunk of the wealth.

Schools like Lehigh mean, for most people getting fin aid, a net of something around $35-45K/yr with a lot of debt. A chunk of that “fin aid” is often more debt. Why is the net so high, because the much poorer kids come from such terrible, underfunded districts, and are at such a competitive disadvantage when it comes to enrichment programs, tutors, activities, libraries, social environment, etc., that they don’t get into the Lehighlike schools in big numbers anyway. Your normal fin-aid kid has parents with college degrees and lower-paid professions, people clinging to what remains of a middle class. The debt they take on to cover that $120+K remainder is not just about the kid’s $30K, though that’s already a problem. The parents sink themselves. PLUS loans, second mortgages, raided and borrowed-against retirement accounts. That’s why we see childless, unmarried 20somethings with life insurance policies. It’s so if they die, their student debt doesn’t crush their cosigning parents even more.

If there is no rationale for taking on this burden, these families will stop doing it. What would remove the rationale for leaping at the fancy schools that are a financial disaster for your family? A reversal of the societal trend to aristocrats and peons. Because then you get, once again, reasonable public schools, public universities that aren’t falling apart, mid-level salaried jobs that support a reasonable life because you don’t have to spend a mint on healthcare, education, housing. And you don’t have to go to expensive schools to have a springboard into that life.

When I went to Lehigh, tuition was $13K, which was a lot at the time — but inflation-adjusted, nowhere near what it is now. Not even close. What’s driven the will to borrow and pay mountains of money for a kid’s bachelor’s degree is not administrators, not Title IX coordinators, not even the existence of the loan programs. It’s not-entirely-unreasonable fear that a kid who goes to a Penn State regional campus will get lost, meet the wrong people, fall into the abyss, and never get a foot on the ladder. That life will be over before it starts. That makes kids and parents willing to wave the money at Lehigh. What drives that fear? A societal reality in which all the goodies are shoved to one small part of the curve, and everyone else gets sketchy neighborhoods, lousy schools, bad medical care, bad food, soul-deadening and unstable jobs, and a life chronically on the financial edge.

When that reality starts changing, and I think it will surprisingly soon, given the demographic and political realities and the fact that we’re already starting to see the changes in legislatures, the Lehighlike schools are in real trouble, unless they’ve got plans for much smaller student bodies or much lower tuitions. What makes that difficult to arrange? Big ol’ debt from recent expansion plans. It doesn’t matter if you tell the kids that they’ll make $60K when they get out, so they’ll pay off their debt fine. They have no reason to take on the debt in the first place, so they don’t come.

Bottom line, a return of the middle class is bad news for a Lehigh predicated on $70K+ COA, much worse if the PtP involves major debt.

I’m sure this will provoke a lot of spluttering and apoplexy among whatever alumni read this, but I bet there’s a Lehigh administrator out there nodding and going “Yup” and making a fatalistic face. And that person will never discuss it with anyone else on campus, because it’s bad practice to start questioning the existence of skyhooks when you need those skyhooks to be real.