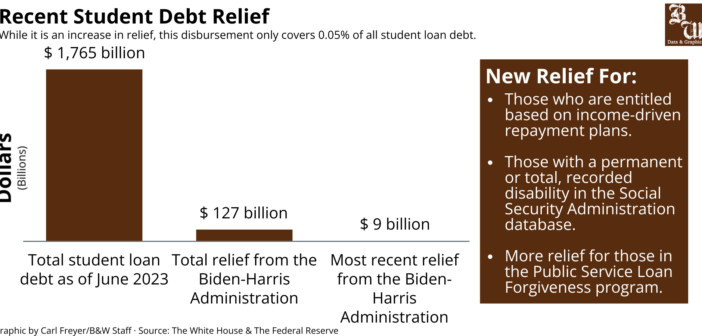

President Biden announced a new student debt relief plan accumulating to about $9 billion and applicable to roughly 125,000 Americans.

The plan, which was released in early October, relieves debt for borrowers under the Public Service Loan Forgiveness programs, those who were supposed to receive debt relief after 20 years of payments but never did, and some individuals with a total or permanent disability.

Jennifer Mertz, Lehigh’s director of financial aid, said this debt cancellation plan is affecting a small portion of overall student debt.

Mertz said the plan will not affect Lehigh students’ financial aid packages. The packages are determined based on current needs and ability to afford tuition, and the financial aid office doesn’t consider repayment plans when offering this need-based aid.

“(Need-based aid) is based on calculations, formulas and family information,” Mertz said. “We are there to help students.”

The plan was developed in conjunction with the Saving on a Valuable Education (SAVE) plan — a revised version of the income-driven repayment plan known as Revised Pay as You Earn (REPAYE).

For income-driven plans, borrowers make monthly payments based on a portion of discretionary income, 150% above the federal poverty line, according to the U.S. Department of Education. A statement from the White House said the SAVE plan is slightly different in that the discretionary income would rise to 225% above the poverty line.

For some borrowers, this could save up to $1,000 per year compared to previous income-driven repayment plans and will still waive all debt accrued for undergraduate study after 20 years of payments.

If a student is confused about the aid they received, Mertz said it is best to go to the Financial Aid Office and simply ask.

The debt cancellation coming from the Biden Administration is designed to cover federal and direct loans, but Mertz said the majority of student loans are private.

Lehigh recently announced the Lehigh Commitment, which provides free tuition to students with family incomes of $75,000 or less, but Mertz said this plan has no correlation to the discussions and implementations of federal student loan cancellation.

The original plan the Biden Administration tried to pass was to cancel $400 billion in student debt, but it was shot down by the Supreme Court in June.

Political science professor Heather Swadley said both the SAVE plan and the additional $9 billion in student debt relief are steps in the right direction as they reduce the amount of a borrower’s income spent on student loan payments.

However, she said smaller, more targeted debt relief programs are an interesting way to approach the issue. She thinks many people may be disappointed this debt relief program is not as “broad,” especially following the Supreme Court ruling in Biden v. Nebraska.

“The tactics that Biden is taking to eliminate debt to targeted sets of borrowers actually insulates that particular debt relief from as many judicial challenges in court, which is going to make it so that at least those borrowers are getting actual debt relief,” Swadley said. “Whereas I think that if Biden tried to pursue a really wide, sweeping debt relief measure, for example, that affected all borrowers, it might be subject to more judicial scrutiny and probably wouldn’t hold up.”

Political science professor Anthony DiMaggio said the Biden Administration is fairly limited in what they can do about student debt relief because the Supreme Court has proven it doesn’t want the federal government instigating progressive programs that aren’t explicitly stated in the law.

He said the way the Supreme Court votes isn’t neutral — the justices’ political values impact how they interpret the law, how they look at cases and how they incorporate court precedent into their decisions.

“It seems increasingly hard to deny that the Supreme Court is pretty conservative today as it’s going out of its way to sort of strike down liberal precedents,” DiMaggio said.

Economics professor Luis Brunstein said student debt relief is not only an economic benefit but sends a positive message from the government to the people.

He said these programs help people feel recognized and acknowledged — like the government is taking care of society in a way expected of them.

“It sends the right signals to young people, who are unsure if they want to go to college, when they see these types of programs implemented,” Brunstein said.

Julie Wright ‘26, president of Lehigh College Democrats, said she doesn’t feel heavily affected by the loan repayment plan right now because it’s based upon post-graduation income.

Though she said it’s a step in the right direction and hopes it will lead to greater talks of assistance in navigating college financial aid, she said changes in the student loan industry are needed.

“Are students who are taking out these loans receiving the proper financial education and resources to effectively make these decisions?” Wright asked.

Comment policy

Comments posted to The Brown and White website are reviewed by a moderator before being approved. Incendiary speech or harassing language, including comments targeted at individuals, may be deemed unacceptable and not published. Spam and other soliciting will also be declined.

The Brown and White also reserves the right to not publish entirely anonymous comments.

1 Comment

I’m relieved to see progress being made on student loan relief. It’s a step in the right direction for countless Americans who are burdened by their debt.