Students awarded financial aid are eligible to receive refund checks from Lehigh each semester. Many students, however, are unsure what a refund check actually is.

Jen Mertz, assistant vice provost of financial services and director of financial aid, said there are two main reasons why.

First, she said, refund checks are sent when a student’s financial aid exceeds their billable costs.

“Cost of attendance doesn’t always equal the billable amount,” Mertz said. “If a student has received financial aid, in many cases, (it’s) because of borrowing loans that exceed the bill.”

A student may also receive a refund check if they live off campus, Mertz said.

She said this is because students living off campus aren’t charged for on-campus housing, but their financial aid remains the same.

“In many of those cases, a student’s aid exceeds their billable cost, and they get a refund, which is supposed to be used for meals and housing off campus,” Mertz said.

Charlotte Imperatore, ‘25, has been receiving refund checks since she first came to Lehigh.

“At first I had no idea what the negative amount on my bursar account was,” Imperatore said.

Imperatore now lives off campus and said she uses her refund check for expenses such as rent, utilities and groceries.

“I have a budget sheet that I use (for) all (of) my monthly expenses for each semester,” she said. “So right now I’m looking at August, September, October, November and December. Then, I factor in Lehigh’s contribution.”

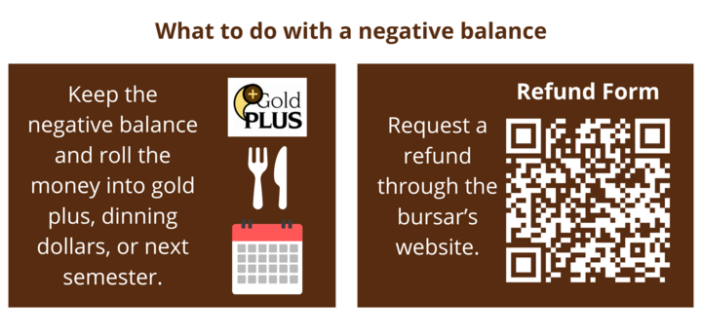

Mertz said refund checks are only processed if a student requests a refund through their bursar account via the refund request form. If students don’t request a refund, the money will roll over to the next semester.

This was a change made in the last year or two, Mertz said.

Mertz said students can best use their refund checks when they request higher loan amounts than the billable amount, especially if they don’t need the refund for off-campus expenses.

“They should email us, and we can reduce the loan to avoid having the credit at all,” she said. “That’s actually the most direct way to reduce the loans.”

Joseph Sanchez, ‘25, has received refund checks since his first year at Lehigh. He said he’s been using his refund towards credits for the next semester.

“I just let (the refund) pay for the next semester,” Sanchez said. “I leave it in the bursar account and then save it as credit for my next tuition.”

He said he didn’t know students have the ability to request a check if they have a negative balance in their bursar account.

“If I knew that I could take it out, I would definitely be using it for groceries or rent,” Sanchez said.

Mertz said reducing the loan is effective in avoiding accrued interest costs on unsubsidized loans and parent PLUS loans.

She also said the Financial Aid Office has many resources available like the PSECU Financial Center to help students learn how to use their refund checks and financial aid payments.

“We have been talking about ways that we can provide better financial education around those (refund checks),” Mertz said.

Mertz said there’s a possibility of holding more financial literacy events to provide students with opportunities on how to effectively use their refund checks.

Comment policy

Comments posted to The Brown and White website are reviewed by a moderator before being approved. Incendiary speech or harassing language, including comments targeted at individuals, may be deemed unacceptable and not published. Spam and other soliciting will also be declined.

The Brown and White also reserves the right to not publish entirely anonymous comments.