Throughout his campaign, President Joe Biden promised to relieve $10,000 of debt for student borrowers. According to CBS News, he has received backlash within his own party, with Democrats specifically calling for more or even less debt relief.

But Biden kept his promise.

His administration announced a three-part plan on Aug. 24, part of which cancels anywhere from $10,000 to $20,000 of student loan debt for eligible students.

“When Biden says something, he usually means it,” said professor Brian L. Fife, chair of the Lehigh political science department. “I really feel that President Biden studied the issue. He didn’t come up with that figure off the cuff.”

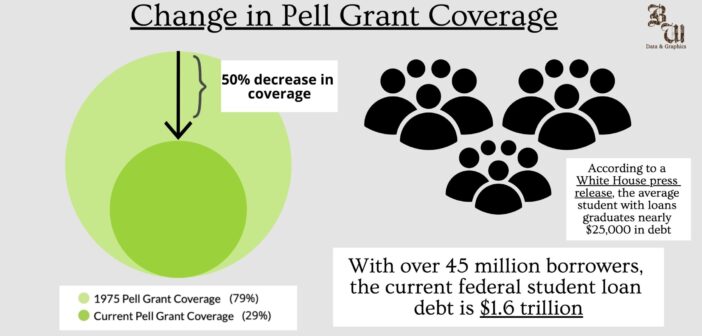

According to a CollegeBoard Trend Report, total costs of both four-year public and private colleges have more than tripled since 1980. Federal aid has not increased at the same rate, leaving many low and middle income students turning to loans to get a degree.

The Biden Administration’s three-part plan offers a targeted debt-relief program to address the burden of rising higher education costs.

The Department of Education will provide up to $20,000 in debt cancellation to Pell Grant recipients, and $10,000 to students who have non-Pell Grant loans held by the Department of Education.

However, not all borrowers will be eligible for this debt-relief. A White House press release states, borrowers are eligible if their individual income is less than $125,000, or $250,000 for married couples. There will be an application process for borrowers to claim relief.

There has also been debate among people who have already paid off their debts and will not be benefiting from the new debt relief plan. Fife is one of those people, yet he said he appreciates the help this can provide current debt-holders.

“I cringe when I think of the amount of student debt that a lot of young people have,” Fife said. “Debt is a huge burden — I know because I have experienced it. It is a huge impediment when you are just starting your life. I do not in any way impugn people for being given a little bit of debt relief.”

For many Lehigh students, debt relief dramatically changes their Lehigh experience.

Fernando Sevilla, ‘24, said he never expected having to take out loans for Lehigh. However, due to COVID-19, Sevilla did not receive the Pell Grant for which he had hoped and had to take out loans in order to attend Lehigh.

“Last year, I worked 40 hours a week as a manager at AMC Theaters (to help pay back loans),” Sevilla said. “If there was no debt relief, I would have been forced to work full time again and therefore would have been in a similar situation as all of last year. ”

He said a plan like Biden’s seemed “too good to be true,” though Sevilla had thought about what life would be like if it happened.

Sevilla said he is now excited for the school year to begin, as he has more time to engage in school, his classes and other students, unlike last year.

But not all students are sure if the new plan applies to them yet.

Fenet Demissie, ‘24, said she does not expect this plan to reach students with similar financial situations to her, at least not in its early stages.

Many students who are more unsure of their eligibility with this plan would still benefit from the financial burdens.

“I personally would be relieved of a lot of my financial anxiety if my student debts were lessened,” Demissie said. “I would be able afford basic necessities, such as health insurance. I wouldn’t have to forgo university insurance, which provides better coverage than my out-of-state California insurance.”

The Biden Administration has also extended the pause on federal student loan repayment through the end of the year. The application to claim relief is set to become available no later than December 31, 2022.

“I hope that students from low-income families will see this as a commitment from the government to support their education and ensure that they have tools available to ensure that all students can pursue a degree, regardless of their family circumstances,” said Jennifer Mertz, director of financial aid. “To that end, Lehigh provides a significant amount of institutional aid — need-based aid — to students whose families have low income and low assets.”

However, this debt relief plan is not permanent as of now. Biden’s presidential successor may choose to either discontinue or extend this plan going forward.

“This one action may not be the end,” Fife said. “There could be a follow-up policy under the right electoral circumstances.”

(Illustration by Frances Mack/BW Staff)

Comment policy

Comments posted to The Brown and White website are reviewed by a moderator before being approved. Incendiary speech or harassing language, including comments targeted at individuals, may be deemed unacceptable and not published. Spam and other soliciting will also be declined.

The Brown and White also reserves the right to not publish entirely anonymous comments.