A recent Supreme Court hearing showed skepticism of the Biden Administration’s plan to forgive over $400 billion of student debt.

The Biden Administration enacted the one-time debt relief initiative in a state of emergency, allowing for the program to cancel student loans up to $10,000 for individuals who made under $125,000 and up to $20,000 for people who receive Pell Grants.

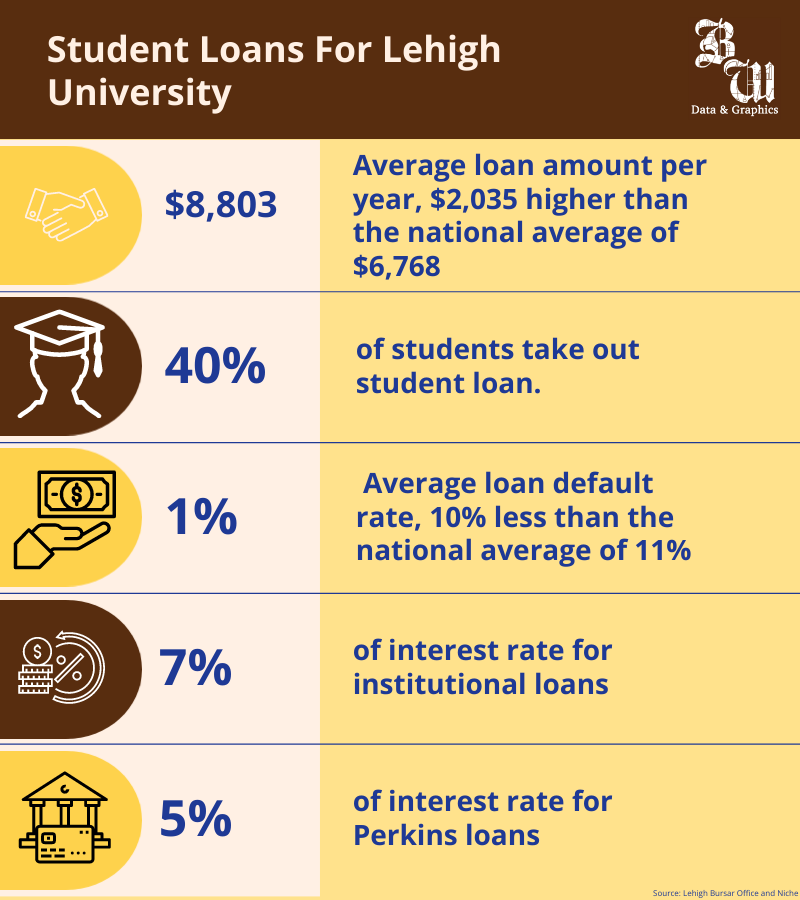

Almost half of Lehigh students have student debt making relief an important issue on campus. (Graphic by Jiecheng Yao/B&W Data & Graphics)

The Feb. 28 hearing, which stemmed from lawsuits filed by six Republican-led states against Biden’s student debt forgiveness plan, resulted in over three hours of arguments and a slim possibility for the president to move forward with the plan. It was seen by the six conservative justices as an overreach of executive power.

Economics professor Ahmad Rahman discussed what he believes the issues with the debt forgiveness plan are and what he thinks are some alternatives.

Rahman said the cost of education is rising at a higher rate than wages, and therefore is a culprit of student debt.

He said a main reason education costs are rising is because students see plans like this and feel they can borrow money because they think the government will forgive them. The program is good in the short term but will end up backfiring in the long run.

Rahman said a long-term solution to this would be to have alternatives in place to help students pay off their loans, along with relief programs. He discussed lowering the cost of education for those obtaining degrees in majors that result in lower-paying jobs or having employers pay off employees’ loans with an annual overall pay reduction to compensate.

“The cost of education is skyrocketing, while wage growth is rising, but not nearly as rapidly,” Rahman said. “So student loan forgiveness does nothing to change the overall trends that we’re seeing here with the cost versus the wage.”

However, he said if loans are forgiven, colleges will feel more inclined to raise education costs because they will believe a precedent is set that the government will pay the portion people cannot personally afford.

An attorney from Forbes found this initiative would have helped over 40 million Americans, and before being shut down due multiple legal challenges, 16 million people were approved to receive the debt relief. According to the Congressional Budget Office, the passing of the program would cost the government $400 billion.

According to the Education Data Initiative, the average student loan debt is $37,574 per person, and there are 43.5 million student loan debt borrowers.

Jennifer Mertz, Lehigh’s assistant vice provost of financial services, said 45% of Lehigh students graduated with student loan debt last year, and 10% of students graduated with at least $100,000 of student loan debt.

Mertz said part of the reason these loans are so high is because of the lack of financial funding from the federal government.

“Lehigh has provided over $125 million in institutional funds in the form of scholarships and grants, and we received $5.6 million in the Federal Pell Grant from the government,” Mertz said.

She said it would be helpful if the government increased the Pell Grant, especially if they approved a proposal to double the it from $7,395 to $14,790. This increase would help schools that lack endowment funds allocate their finances toward improving their campuses or education system.

Grace Lewis, ‘23G, said the Supreme Court should not be ruling on whether or not Biden’s plan is an abuse of power, and this issue should instead be disputed between Biden and Congress.

She said the court should be looking at whether or not the plaintiffs will directly benefit from the disapproval of Biden’s plan, and in her opinion they will not.

She said Biden’s student loan forgiveness package would directly affect her and many of her friends who have incurred student loans.

Lewis said she would like to see alternatives to help students pay for student loans and feels it is unfair that people can get assistance paying for loans on a home or a business.

“If the pathway to this happening through an executive order obviously is closed, then what I would like to see is Congress pass some laws, if not for debt forgiveness, then lowering the interest rates that are on the loans to begin with,” Lewis said.

Lewis expects the Court will ultimately rule based along party lines — and there is currently a conservative majority.

Comment policy

Comments posted to The Brown and White website are reviewed by a moderator before being approved. Incendiary speech or harassing language, including comments targeted at individuals, may be deemed unacceptable and not published. Spam and other soliciting will also be declined.

The Brown and White also reserves the right to not publish entirely anonymous comments.